Gross pay represents what you earn before taxes and all the other deductions. Net pay is the money you actually take home. Anyone who’s ever read a pay stub knows those two are quite different.

Understanding how gross pay becomes net pay and what the difference is will help you understand where your money is going. It’s important to know what each deduction is and what (if anything) you get in exchange.

What Is Gross Pay?

Gross pay represents the total amount of money an employee earns before deductions, such as taxes and other withholding amounts. It is the compensation an employee receives for all their work hours or the work they completed during a pay period.

Gross pay forms the basis for calculating an employee’s net pay, the amount the employee takes home after all deductions.

What Goes Into Gross Pay

Gross pay typically includes regular pay, bonuses, and overtime pay, but may also involve other forms of compensation such as commissions, profit-sharing, and non-taxable benefits.

- Regular Pay – Employees are guaranteed to receive this base salary for their regular work hours. It is usually a fixed amount determined by the employee’s job title, experience, and qualifications. It may be calculated as an annual salary or an hourly rate.

- Overtime Pay – Income earned for working hours that exceed the standard 40-hour work week is overtime pay. It is usually calculated at a premium rate, typically 1.5 times the regular pay rate.

- Bonuses – Bonuses are additional payments employees receive as a reward for good performance or to recognize exceptional achievements. Bonuses are not guaranteed and are often discretionary.

- Profit-Sharing – Some companies choose to distribute a portion of their profits to employees. The amount of profit-sharing an employee receives is usually based on company and individual performance.

- Commissions – A commission is a payment made to an employee based on their performance. It’s a typical compensation in sales jobs and can significantly affect an employee’s overall income.

How to Calculate Gross Pay

How you calculate gross pay depends on whether you receive an annual salary or hourly wage. While salaried employees are typically paid a fixed amount divided into 12 installments for 12 months, being paid by the hour means your payment depends on the total number of hours you work. Here are the two different calculations for gross pay.

1. Calculating Gross Income as a Salaried Employee

When you receive an annual salary, all your payslips will show a recurring figure indicating your gross pay for the particular month.

If you want to calculate your annual gross salary, you can multiply your gross monthly income by 12. Include all short-term and long-term bonuses to get an accurate number.

Another way to calculate gross income as a salaried employee is to divide the annual gross salary by the number of pay periods, usually 12.

For Example

For Example

Let’s say Michael’s annual income is $65,000. He receives his pay on a semi-monthly schedule, which amounts to 24 pay periods within a year. An easy way to calculate Michael’s gross income per pay period is to divide his annual income by the number of received payrolls, which is 24 in this case. This formula shows that each of Michael’s paychecks is $2.708.33.

2. Calculating Gross Income as an Hourly Employee

If you’re paid hourly, you can also calculate your gross income in two different ways.

One way to do it is to collect the payslips from your previous year and add the gross income for every month to discover your annual gross income. Calculating your gross income for the future is a bit more challenging simply because you can’t know with absolute certainty how many hours you’ll work or how much money you’ll make.

If you work regular work hours, you can multiply your hourly pay rate by your guaranteed weekly hours to get your weekly gross pay. Then multiply that number by four weeks to receive your monthly gross pay or by 52 weeks to get your annual gross pay as a wage employee.

For Example

For Example

Let’s say that Izzy covers an extra shift every other week, which means eight hours of overtime on a two-week basis. Her regular hourly rate is $20, and her overtime rate is $30. Here’s what her two-week pay period looks like.

In the first week, Izzy works a regular 40-hour week. Since her hourly rate is $20, her gross pay for the first week is $800. The same goes for the second week. However, she works an additional eight hours with a $30 hourly rate. That’s $830 for the second week and $1,630 total gross pay for the two weeks.

What Is Net Pay?

What Is Net Pay?

Net pay refers to the amount of money an employee takes home after all the deductions and taxes have been taken out of their gross pay.

Deductions include federal and state income taxes, Social Security taxes, Medicare taxes, and other deductions. In addition to federal and state taxes, some employees may have additional deductions taken out of their pay, like 401(k) contributions and health insurance premiums.

Net pay is the amount of money left after all these deductions have been taken out. These deductions can significantly reduce an employee’s net pay, so it’s vital to understand how they are calculated and how they will impact an employee’s take-home pay.

Employers are required by law to provide employees with information about their gross pay, deductions, and net pay. This information is usually included on the employee’s pay stub, a document given to the employee each time they’re paid.

Employees should review their pay stubs carefully to ensure the calculations are accurate and that the correct amount of money is being taken out for the deductions.

Mandatory Deductions

Some payroll deductions are mandatory, meaning that everyone has to pay them.

1. Income Taxes

The largest mandatory income deduction is usually the federal income tax. There are several tax rates, depending on your income, so tax ranges from 10% to 37%.

Your employer will set your withholding rate, but you can ask them to change it. If the amount withheld in a tax year is greater than your tax due, you will receive a refund. If the amount withheld is less than the amount due, you will owe an additional sum.

Some states may impose additional income taxes, which will also be deducted.

2. FICA Tax

This tax covers Social Security and Medicare, important benefits when you retire.

The total FICA payroll tax rate is 15.3% of your gross pay. The employer pays half of this tax, and the employee pays the other half (7.65% each). 6.2% goes toward Social Security and 1.45% toward Medicare.

There’s a cap on the gross pay subject to Social Security tax. It’s called the Social Security wage base and is $160,200 for 2023. Any earnings above $160,200 aren’t subject to Social Security tax.

An additional Medicare tax is paid by employees who earn more than $200,000 in gross income. It is 0.9% of all gross incomes over $200,000.

3. Wage Garnishments

Wage garnishment is a legal process that orders an employer to withhold a part of someone’s earnings, paying them directly to a creditor to satisfy a debt. That can happen due to a court order, a government agency request, or other legal action.

Wage garnishments may include student loans, taxes, and unpaid alimony child support. Payment for a civil debt may be garnished if the creditor sues you and wins.

Voluntary Deductions

Not all gross income deductions are obligatory. Many are voluntary. Individuals can choose how much money, if any, they want to set apart for some voluntary deductions.

1. Health Insurance

Employers with more than 50 employees are required to offer employer-sponsored health insurance plans. The cost of these plans is usually split between the employer and the employee.

Participation in these plans is not mandatory, but they are usually less expensive than an equivalent plan sourced independently would be.

2. 401(k) Plans

A 401(k) plan is an employer-sponsored retirement savings plan designed to help employees save for their retirement years. It is named after the section of the Internal Revenue Code that governs it.

Under a 401(k) plan, employees can have a portion of their paychecks withheld and placed into a tax-deferred retirement account. The employer may also choose to match a part of the employee’s contributions, which can significantly increase the amount of savings.

The funds in the 401(k) plan grow tax-free until the employee retires and starts taking withdrawals, at which point the withdrawals are taxed as income.

3. Additional Insurance

Some employers may also offer life insurance or other insurance benefits. These are always optional. If you see an insurance-related deduction on your pay stub, ask what it is and what benefits you will receive, so you know whether the benefits are worth it to you.

4. HSA, FSA, AND HRA

Some employers offer accounts like an HSA (Health Savings Account), FSA (Flexible Savings Account), and HRA (Health Reimbursement Arrangement). These are all types of savings or spending accounts that are used to pay for health-related expenses. These accounts can be helpful for individuals who want to set aside funds specifically for health-related costs and take advantage of tax benefits.

5. Union Dues

Union dues are fees paid by union members to their union as a membership requirement. The dues are used to support the operations of the union and its activities, such as collective bargaining, contract administration, and representation of members in disputes with employers.

Union membership may be mandatory in some workplaces.

6. Work-Related Tools or Uniforms

Some employers may deduct all or a portion of the cost of work-related tools or uniform purchases.

7. Charitable Donations

Employees can also automatically donate a portion of their pay to various charities. The donations are entirely voluntary, so individuals can choose how much money they want to give and to which charities.

How to Calculate Net Pay From Gross Pay

Net pay represents the amount of money that an individual receives after all deductions have been taken from their gross pay. To calculate net pay from gross pay, you must subtract all relevant deductions from the gross pay amount.

Here’s a step-by-step guide on how to calculate net pay:

Here’s a step-by-step guide on how to calculate net pay:

- Determine the gross pay: Look into the total amount earned before deductions.

- Identify the relevant deductions: Determine federal and state income taxes, Social Security and Medicare taxes (FICA), wage garnishments, union dues, and any other mandatory or voluntary deductions.

- Calculate the total deductions: Add up all of the relevant deductions.

- Subtract the total deductions from the gross pay: The result represents the individual’s net pay.

Gross Pay vs. Net Pay Example

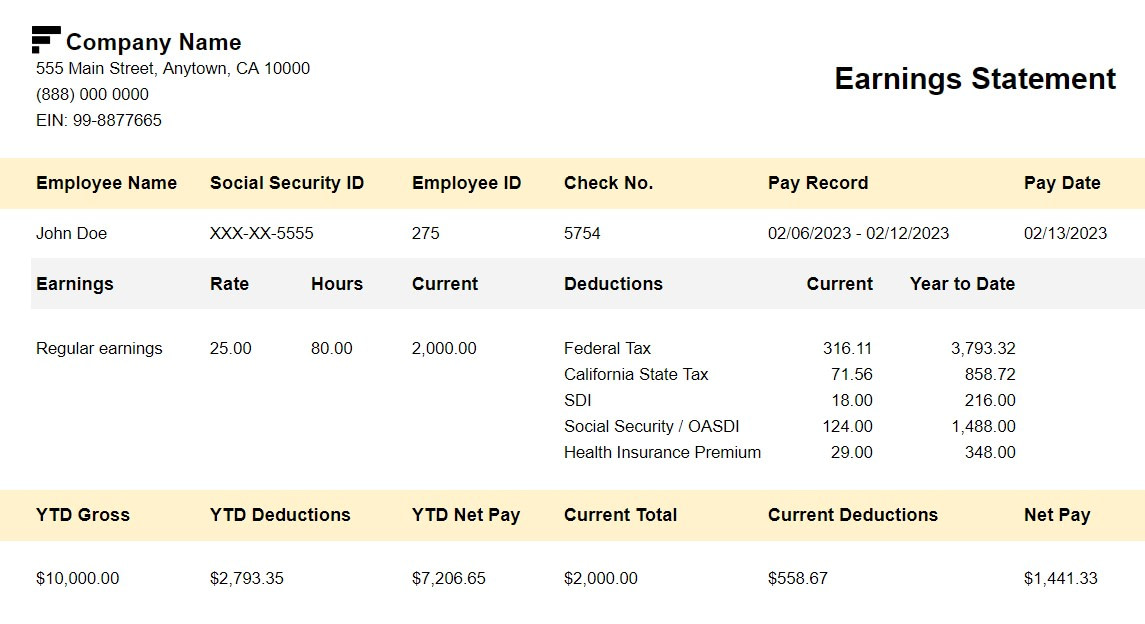

Here’s a sample pay stub.

We can see that the employee worked 80 hours at an hourly rate of $25.

Gross pay: 80 x 25 = $2,000.

There are also several deductions.

- Federal tax at $316.11

- California Income tax at $71.56

- SDI or State Disability Insurance at $18

- Social Security and Medicare at $124

(OASDI stands for Old Age, Survivors, and Disability Insurance and is another name for Social Security). - Health Insurance at $29

Net pay: $2,000 – $316.11 – $71.56 – $18 – $124 – $29 = $1,441.33

The sum of the deductions for this payroll period is $558.67, leaving a net pay of $1,441.33.

The pay slip will also give you your total earnings, total deductions, and total net pay for the year to date.

Your pay slip may vary, and there may be other deductions, but the basic method of calculating net pay from gross pay remains the same.

Final Thoughts

As you can see from the example above, net pay can be substantially lower than gross pay. It’s important to remember that if you’re just starting out as an employee. A salary that sounded adequate on a gross basis may be less than adequate once you calculate all deductions.

Once you gain more experience with paychecks, you’ll learn about the various deductions and how to anticipate the pay you’ll actually be able to spend. In the meantime, if you see a deduction that you don’t understand, don’t hesitate to ask your employer what it is and why it’s necessary!

The post Gross Pay vs. Net Pay: What’s the Difference? appeared first on FinMasters.

FinMasters