Table of contents:

Quick Stock Overview

Innoviva by the numbers.

1. Executive Summary

A brief discussion of Innoviva and its potential appeal to value investors.

2. Extended Summary

A more detailed explanation of Innoviva’s business and competitive position.

3. A different kind of biotech

Innoviva unique business model.

4. A Messy Past

A complex corporate structure that got slightly simpler

5. The growth Portfolio

VC investments in biotech startups and one unique technology with outstanding potential.

6. Conclusion

Why Innoviva is worth a closer look.

Quick Stock Overview

Ticker: INVA

Source: Yahoo Finance

Key Data

| Industry | Biotech |

| Market Capitalization ($M) | 1,041 |

| Price to sales | 3.4 |

| Price to Free Cash Flow | 3.5 |

| Dividend yield | – |

| Sales ($M) | 396 |

| Free cash flow/share | $4.23 |

| Equity per share | $5.553 |

| P/E | 6.7 |

1. Executive Summary

Innoviva is a pioneer in the new business model of biotech royalties. The royalty model used to be reserved for the relationship between major pharmaceutical firms and up-and-coming biotech startups. So while this model is not entirely new, pure players focused exclusively on royalty revenue are still rare.

Thanks to its earlier success, Innoviva now has a solid portfolio of royalty streams from drugs used in the treatment of pulmonary issues and asthma. Just by itself, this cash flow could justify Innoviva’s current valuation.

Innoviva has also entered a neglected but potentially very lucrative new field of medicine. I personally think this is a therapeutic method with tremendous potential for growth and it is one I have been looking out for – unsuccessfully, I must say – until I looked at Innoviva’s recent investments.

Investment in Innoviva has been complicated by a very arcane corporate structure that includes a spin-off, royalties agreements, commercialization by third parties, litigation, and other factors. The company structure and royalty deals are a guaranteed headache when you first try to figure them out.

This complexity is in large part responsible for the company’s low profile with investors. Innoviva is difficult to analyze, future growth has been hard to predict, and many investors just put it in the “don’t understand” pile. That lack of easy appeal may explain why the Company’s stock price remained essentially flat through the recent bull market and valuation metrics remain so favorable.

With several key litigations now closed in Innoviva’s favor, the path forward for the company is much clearer. Its corporate structure is also a lot simpler since a massive stock buyback pushed out a large pharma company that used to own parts of Innoviva.

The renewed Innoviva combines a simpler structure, strong cash flow, a high-quality portfolio of approved drugs, and an attractive portfolio of innovative treatments. This makes for an interesting long-term compounder in a field independent of market tumults like interest rate, inflation, and energy prices.

This report first appeared on Stock Spotlight, our value investing newsletter. Subscribe now to get research, insight, and valuation of some of the most interesting and least-known companies on the market.

Subscribe today to join over 9,000 like-minded investors!

2. Extended Summary: Why Innoviva?

A Different Kind of Biotech

Innoviva is adapting the royalty business model to the biotech industry. It currently collects royalties from approved and commercialized drugs generating a net income equal to 1/4 of its current market cap. It also uses this money to reinvest in a diversified portfolio of biotech startups in order to create new income streams beyond the 2030 horizon.

A Messy Past

Innoviva has a complicated history, transforming from a classic biotech startup to a royalty company. This resulted in a messy corporate structure that can be hard to understand. This made the investment case for Innoviva unnecessarily complex. This has improved with successful litigation confirming Innoviva’s ability to direct the royalty cash flow to new investments and separation from the pharmaceutical giant GSK, which previously owned part of Innoviva.

The Growth Portfolio

Through its royalty division, Innoviva has invested in a wide array of promising biotech startups. It also has direct controlling investments in the companies working on solving the problem of antibiotic resistance. The most promising is Armata, which uses extremely innovative therapy concepts based on bacteriophages.

3. A different kind of biotech

The Royalty Business Model

Biotech companies operate in a complex regulatory environment and develop very technical products. This often leads early-stage companies to specialize in only one field of medicine or just one type of therapy/molecule.

This can be a successful strategy. It also exposes its shareholders to the inherent incertitude of research, clinical trials, and changes in medical practices. The only alternative to these highly focused biotech startups used to be large, slow-moving, somewhat bureaucratic pharma giants.

In a previous report on Regeneron, I compared Biotech companies to mining companies.

Both need a lot of CAPEX, both face unknown success in exploratory/R&D efforts, and both can, as much from luck as much as from skill, go bust or hit the motherlode (or the blockbuster drug, for biotechs). They also both need to constantly find new revenues to compensate for declining ones (ore reserves/patent expiring).

So it may not be surprising that a business model now popular in the mining industry is making its way into the biotech industry as well. This new type of company is a royalty company.

The most acclaimed royalty company is Wheaton Precious Metal, which specializes in gold miners’ royalties. I think its stock price chart, going x10 in a decade and a half speaks for itself. Notably, it achieved a much better and smoother performance than the gold mining sector it covers.

A royalty company provides financing, advice, connections, and support for a risky endeavor. This is similar to the Venture Capitalist strategy. The difference is that instead of asking for part ownership of the company, a royalty agreement agrees on a part of the future income stream generated by the asset financed. In the case of Wheaton, a gold mine. In the case of Innoviva, a new patented drug.

In their early stages, royalty companies can be as risky as a startup. Either the first investment pans out, or it fails. But once a solid income stream is secured, a royalty company has more flexibility and more ability to diversify than a biotech startup would. Innoviva is at exactly this inflection point.

After hitting jackpot, a normal biotech company would aim to double down on its expertise, existing machinery, medical knowledge, and scientific team by exploring similar drugs using similar technology. Unfortunately, in biotech, past successes are not always indicative of future achievement. A royalty company can much more easily diversify its portfolio by pivoting to other medical fields or types of drugs.

The deal is also attractive for the start-up selling the royalty. Instead of permanently giving up a part of the company to an outside investor, it retains full control of future products. So more often than not, they agree to a higher percentage of future income of that first drug than they would have agreed to sell as a percentage of the whole company.

Investors in royalty companies have to consider how capital efficient the company can be. Past the initial investment, future incomes do not require more CAPEX, R&D, or other expenses. Once a stream of income is secured, free cash flow can be very significant. A royalty company is not hiring hundreds of researchers and salespeople. So most of its income is pure profit from past investments, with very little overhead.

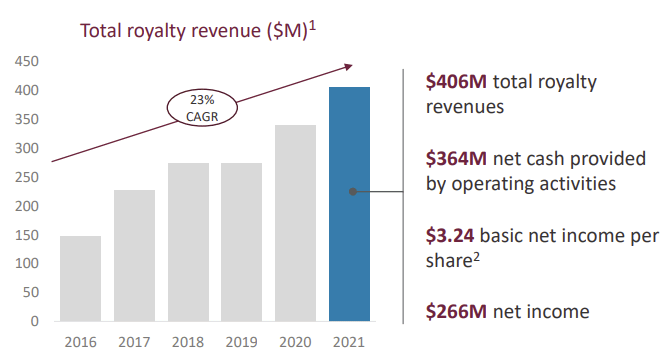

You can see Innoviva’s profitability below. Keep that $1B current market cap in mind!.

Innoviva’s Current Portfolio

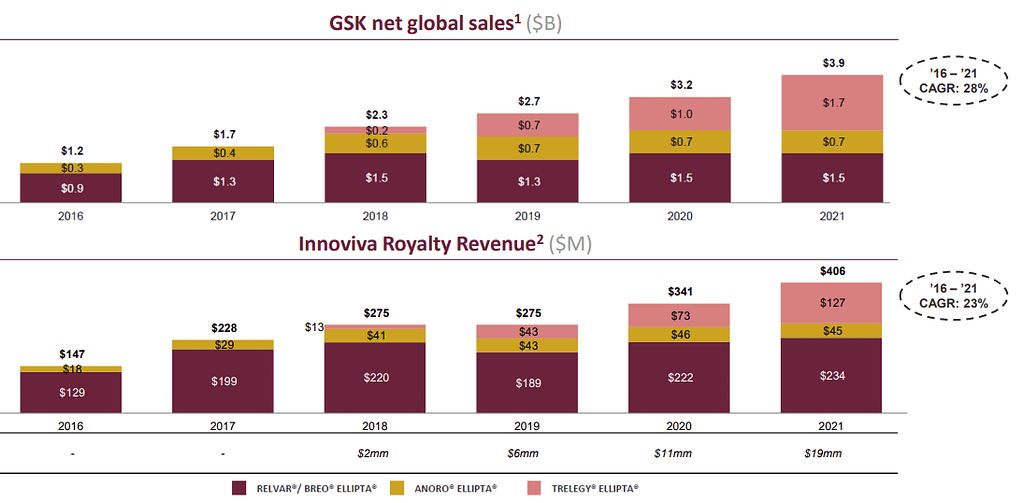

Innoviva’s active royalty stream is built on 3 FDA-approved treatments, all built on combinations of 3 different drugs. Innoviva holds royalty rights to all three drugs.

Relvar is the oldest drug, launched in 2013. It offers a once-a-day treatment for asthma.

Anoro was launched in 2014 and represented a significant improvement over previously existing pulmonary treatments.

Trelegy was launched in 2017 and represents an upgraded version of Relvar, adding a third molecule to the mix. It is used for asthma, chronic bronchitis, and emphysema.

Both Relvar and Anoro are expected to have a stable market size going forward.

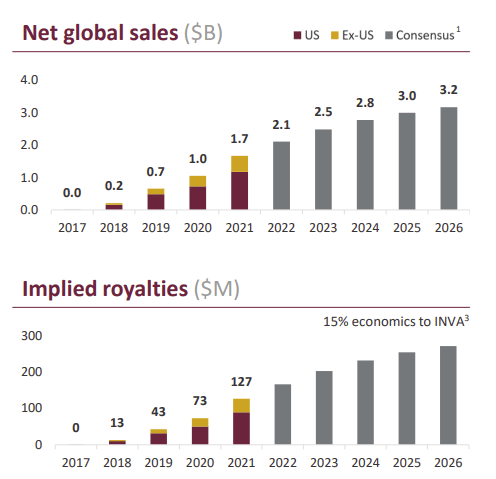

Trelegy is where Innoviva expects growth to come from in the next years, with the global sales (and royalties) expected to double by 2026.

Source: Innoviva Corporate Presentation

Royalty Income

Since 2016, royalties revenues have grown steadily, first due to Relvar and Anororo sales ramping up, and then due to Trelegy entering the market.

If the market for asthma and pulmonary treatment stays stable, Innoviva should register a royalty income of approximately $550M in 2026. That’s half of the current market cap.

Innoviva’s royalty model allows the company to minimize operating expenses, leading to exceptionally high margins. Innoviva’s operating margin is currently 95.02%

For each of these drugs, patents cover not only the molecules and the drugs but also the process to produce the molecules and devices to deliver them to the patients’ lungs. This gives a patent expiration date in the 2030-2033 range, a rather long patent protection period by industry standards.

The market for asthma and pulmonary drugs is very active, with plenty of competitors. Innoviva’s annual report list no less than 28 competitors. Guidance on treatment protocol from medical institutions can change over time, so again, the further in the future the harder royalties are to predict.

I would not count on royalty revenues to stay permanently high until the 2030s, but until 2025-2027 would be reasonable.

I nevertheless expect the cumulative net income of Innoviva to be above the current market cap. And that’s with a conservative view of the existing portfolio, ignoring all future revenues from new treatments (see below).

4. A Messy Past

Foundation and Spin-Off

It honestly took me a while to understand the story of Innoviva. I hope I got everything straight by now, but I might have missed or simplified a few details due to the complexity of the history and structure. This is because the company started as a classical biotech startup and then signed a deal with GlaxoSmithKline (GSK), a major pharmaceutical firm. Under the agreement, GSK would manufacture and promote the new molecules while paying a royalty to Innoviva.

Innoviva then spun off its R&D division as Theravance Biopharma, which owns 85% of Theravance Respiratory Company (or TRC), leaving the current Innoviva as a pure royalty company.

If the story stopped there it would be still somewhat simple. But there were still 2 issues, one involving litigation with TRC and one involving the relationship with GSK.

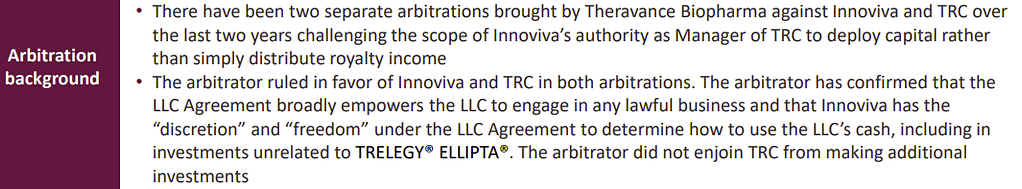

Litigation

The GSK royalty is paid to Theravance Respiratory Company (or TRC).

Theravance Biopharma, despite controlling 85% of TRC, is not the manager of TRC. Innoviva is the manager and decision-maker for TRC.

Innoviva has used some of the royalty money received by TRC to keep improving the existing asthma portfolio, including launching Trelegy. It also invested in multiple new ventures, as ultimately, 15% of any future investment success of TRC will go to Innoviva.

Theravance Biopharma wanted all the royalties to be distributed proportionally to the owners of TRC (85% Theravance, 15% Innoviva). The dispute about how TRC cash flow should be managed escalated up to a court case.

In 2 separate rulings, Innoviva won the court case. The court ruled that Innoviva can use the cash flow of TRC in any legal action likely to generate income in the future, including investment in non-pulmonary drugs. This means that from now on, TRC will be an extra channel for Innoviva to invest in promising drugs and biotech start-ups.

Theravance’s insistence on making a quick buck and staying on respiratory treatment only was pretty short-sighted in my opinion. Any commercialized drug needs some cash flow used for ongoing clinical studies, patent prolongation strategy, etc. Without new investment, the existing portfolio would just slowly wither away past 2033.

So having the court ruling in favor of Innoviva is a good thing for the future of the royalty income stream from TRC.

Relationship With GSK

The relationship with GSK is one of past success and current tensions. The drug development deal with Innoviva/Theravance was highly successful. Still, some diverging interests remain.

First GSK has other drugs that also treat asthma and pulmonary congestion. So it is a risk that at some point GSK, who is in charge of producing, promoting, and distributing Innoviva’s drugs, might switch focus to some other product.

Together with increased competition, this is the largest uncertainty regarding the current royalty income. I am not sure how likely this is, but this is a risk to take into account.

The second issue was GSK’s 32% ownership of Innoviva, which was left over from previous deals. This made Innoviva’s decision-making process far from independent and was potentially disadvantageous to minority shareholders.

In May 2021, Innoviva repurchased all these GSK-owned shares and is now fully independent. Considering the transformation of Innoviva in recent years, getting total independence from GSK was a must. This clears the way for the Company’s new model of pure royalty player.

5. The Growth Portfolio

Push for Diversification

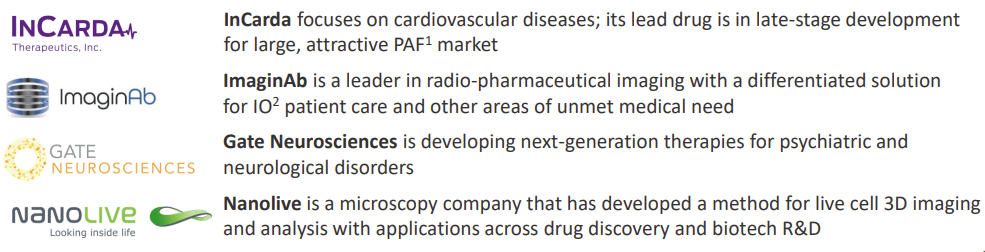

TRC is diversifying its portfolio by reinjecting income from the 3 active drugs into new ventures. Conforming to the royalty company model, TRC (and through it Innoviva) is diversifying its risk instead of focusing only on one medical field.

The new investments include:

InCarda allows life-saving cardiac treatment to be administered at home, thanks to a breathable delivery system. TRC owns 13% of InCarda.

ImaginAb is an imaging system that reduces the need for biopsies in cancer patients. TRC own 14.5% of ImaginAb.

NanoLive is an imaging system that works as an R&D tool for drug discovery. TRC owns 16.1% of NanoLive.

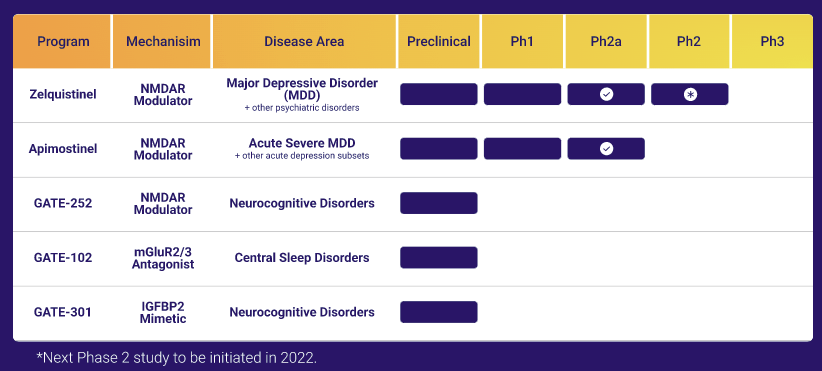

The last venture, GateNeuro is maybe the one with the most potential. It focuses on essentially untreated or poorly treated problems: depression, sleep disorders, and other cognitive issues.

TRC owns 8% convertible notes in GateNeuro, worth $15M at investment. The final value of the converted shares will depend on the price paid for the acquisition of GateNeuro or the valuation in an IPO.

The Acquisitions

Aside from its present and future royalty streams from TRC, Innoviva has also directly invested in promising startups. Considering that Innoviva owns only 15% of TRC, I suspect these direct investments bypassing TRC are the ones for which Innoviva has the largest hopes.

This complicates the corporate structure and it diverges from the pure royalty strategy, but we are getting used to arcane business situations.

Remarkably, both companies with direct investment from Innoviva are in the same field, with different technical solutions. Both address the growing problem of bacterial resistance to antibiotics.

Until the 1940s, even simple infections like a scratch or a cold could prove deadly if you were unlucky. That does not even include then-incurable diseases like tuberculosis. The arrival of Penicillin and other antibiotics was nothing short of miraculous. The problem is that bacteria are growing increasingly resistant to existing treatments, becoming so-called “superbugs”.

Just in the EU, 33,000 people die every year from antibiotic-resistant bacteria. This is more than the flu, tuberculosis, and HIV/AIDS combined. The number is similar in the US. And it is overall getting worse.

So it’s easy to understand why Innoviva would want to invest in startup innovation in this field.

Entasis

On May 23rd this year, Innoviva bought all the outstanding sharing of Entasis at a 50% premium. The company is developing new antibiotics able to overcome the resistance of superbugs responsible for lung, urinary tract, and blood infections, as well as gonorrhea.

So far trials have been going well, with the gonorrhea clinical trial already in phase 3 (the last one before potential approval). This look like a neglected and potentially very profitable niche market with few competitors working on alternative products.

Armata

The last and certainly not least acquisition is Armata Pharmaceutical. At the end of 2021, Innoviva owned 60% of Armata and has since invested an additional $45M in February 2022.

You see, every newly found antibiotic is doomed to face some resistance at some point. One day we might run out of new ideas, and this would bring us back to the pre-1940 world without antibiotics. This would probably bring a Covid-level death toll, but yearly without an end in sight. By 2050, antibiotic resistance is expected to cause more death than cancer. Companies like Entasis delay this problem but do not fully solve it.

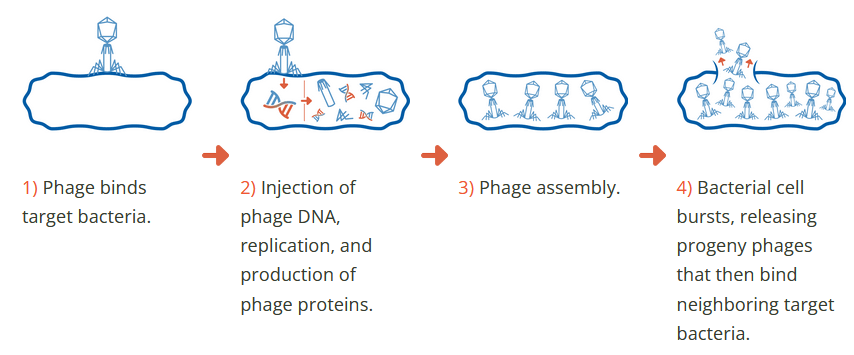

But there is in nature one threat bacteria have never been able to shake off permanently. This is an enemy even better than bacteria at mutating and evolving to keep the upper hand in the evolutionary arms race. I am speaking of viruses.

More precisely, a specific type of virus called a “bacteriophage”, which is fundamentally unable to attack any life form other than bacteria. These phages are all around us, all the time, and have been on Earth for billions of years.

Armata has great explanations about phages on its website here and more advanced info here.

Here are some of the multiple advantages of using phages over antibiotics:

- no toxicity or side effects like with antibiotics.

- phage multiply by killing bacteria, potentially helping to hunt down hard-to-reach bacteria deep in the body of the patient.

- no effect on other than the targeted bacteria (each phage is specialized in killing a specific type of bacteria), reducing damage to other beneficial bacteria in the patient’s body.

The idea is not fully new but was missing modern technology to be brought into Western medicine. Some therapy already exists in Russia and Georgia, the result of Soviet-era research on phages, but their efficiency is not really known as their clinical trials are not following international standards. The method was essentially to find phages that might work for a patient with a chronic condition.

Before becoming a financial analyst and a finance writer, I was a molecular biologist. And already 10 years ago, I felt that bacteriophage therapy had the kind of potential that would make a great investment.

The problem was that there was no company to invest in. Back then it was only pursued in Georgia, so it was not a good career plan either. Luckily, this has changed.

Armata offers a fully integrated method to design phages through its synthetic phages platform. It includes a phage discovery protocol, a database of useful genes, and an in-house procedure to design and mass-produce a custom phage adapted to a specific clinical problem.

The field is not limited to Armata alone, but competition is minimal. The leading institution in the field, the Georgian Phage Therapy Center lists only 14 companies developing phage therapies. Three of these are Georgian or Russian (good luck reaching the Western market in the current geopolitical context).

So it seems that a field likely to solve a problem that could cause millions of death per year has under 11 companies working on it at most. Maybe a few more like Armata are staying discreet about their work until being acquired. I am willing to bet that funding from Innoviva and its experience in bringing drugs to market will give Armata the upper hand in a sector with very limited competition.

How to Value the Royalties & Acquisitions

Properly judging the value of private investments and VC-driven investments is notoriously difficult. In a field with a lot of hard-to-predict outcomes, valuation is speculative at best.

Luckily, Innoviva’s current valuation can be fully justified by its likely free cash flow from its existing approved products. So I would consider the situation where only Armata or Entasis succeed, or both fail but a few of the TRC’s investments bear fruit. Even in such a pessimistic scenario, Innoviva will still inherit a new revenue stream for 1-2 more decades after the expiration of its current drug patents. Anything better than that would be a bonus.

I personally don’t like to bet on clinical trial outcomes, as those are mostly unknowable. But if the price is right, any positive outcome coming from the research portfolio comes as a cherry on the cake of current cash flows of approved and commercialized drugs.

In that context and with that level of margin of safety, I feel a lot more comfortable expecting that something, anything, will work in the diversified portfolio of Innoviva. That would only add value on top of safer, ongoing revenues.

6. Conclusion

The hardest element of biotech investing is dealing with unpredictability. Multiple factors can change a company’s prospects overnight: clinical trials, changes in medical guidelines, drug reimbursement rules, and many more are impossible to anticipate. It makes sense that cautious investors would look for maximum diversification.

To reach such a level of diversification without direct investment in tens of companies, only two options existed. One is Biotech ETFs, mixing together companies with high and low valuations and qualities. Another one is buying giant pharmaceutical companies, with the promise of somewhat stable results, but a limited upside as well.

I think a royalty and direct investing company like Innoviva offer a great alternative to either ETFs or Big Pharma. It has an existing and stable revenue stream but also invests in new drugs and treatments. Unlike a growing successful startup, it has diversified in multiple fields and types of treatment and has the capacity to continue diversifying

At the current valuation, even a conservative estimate of the existing royalties on approved drugs can justify the company’s value. When adding the potential of investment in startups, the current valuation seems cheap.

At first, the complexity of the corporate structure looked like a problem to me. But after thinking about it, I think this is a strength. Through its management of TRC together with its minority ownership, Innoviva can make multiple investments in very diverse fields, imitating the VC business model. But when it gets into contact with a really promising idea, as with Armata, it can also do a direct acquisition and not have to share the result with the other shareholders of TRC.

So while this might distract or deter some investors, I think this is an ideal model to maximize value creation in the long term. This also explains with Theravance, the other owner of TRC, was so opposed to it. It wanted all that juicy cash flow from royalty to flow to its own R&D effort.

With the court ruling strongly in favor of Innoviva, I think this model is now secure, de-risking Innoviva from the governance risk point of view.

I think it is a fool’s errand to put a precise number on the value of the investment on Armata and Entasis. There are too many unknowns to give a solid estimate.

Nevertheless, considering the growing issue of antibiotic resistance, I feel Entasis might just have a solid niche ahead if its drugs get approved.

With Armata, Innoviva is the only publicly traded stock I know of that is involved in bacteriophage treatment. I have been looking out personally for such investment for years, actually way back to when I was a biochemistry researcher in Switzerland. The investment in Armata was a large part of what attracted me to Innoviva in the first place.

Will it work out? Maybe. This is biotech, where failure is the norm, not the exception. But if it does, it might make Armata (and Innoviva) the pioneer in a revolutionary field of medicine.

Looking at the current market cap, I feel that the market has just wholly missed this potential. Maybe not surprising, as it’s an obscure topic to non-biologists. So through Innoviva, Armata is still selling on the cheap.

At least for now…

Holdings Disclosure

Neither I nor anyone else associated with this website has a position in VWAGY or plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation from, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of FinMasters are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This article is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this article reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of FinMasters) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

We did not receive compensation from any companies whose stock is mentioned here. No part of the writer’s compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this article.

The post Innoviva (INVA) Stock Analysis appeared first on FinMasters.

FinMasters