Credit repair software is designed to help you clean up your credit profile on your own. There is no waiting around for someone else to do all the work, as there is with credit repair services.

Credit repair software can also help credit repair businesses to organize their clients and workload.

Credit repair software can be a middle ground between DIY credit repair, which may seem like an overwhelming challenge, and hiring a credit repair company, which is expensive and can be risky if you get the wrong company!

In this guide to the best credit repair software, we take a look at the features of 5 top credit repair software solutions to help you make the best credit repair decision.

How Does Credit Repair Software Work?

Credit repair software offers resources and tools to help you and/or your clients fix their credit.

These software packages focus on identifying the issues that are hurting your credit score and helping you to fix the problems.

One of the most common courses of action in credit repair is filing disputes with the credit bureaus. Disputes can be filed on collections, inquiries, late payments, and other credit problems.

To assist with disputes, most credit repair software offers letter templates or auto-filled letters and assists with filing and tracking disputes.

It is important to note that credit repair software and credit repair services are not the same. Credit repair services offer dedicated one-on-one coaching and guidance and are regulated by Credit Repair Organization Act (CROA).

Best Credit Repair Software Options

In this article, we’ll look at 5 credit repair software solutions currently being offered for sale. Some of the packages we will cover are designed for use by credit repair businesses, while others are limited to individuals.

- Credit Versio – Best for personal credit repair

- Dispute Bee – Best for credit repair business client resources

- Credit Repair Magic – Best for learning about credit repair

- Credit Detailer – Low-cost option for credit repair businesses

- Credit Repair Cloud – Best for marketing and support

We’ll review the pros and cons of each software solution and evaluate their costs.

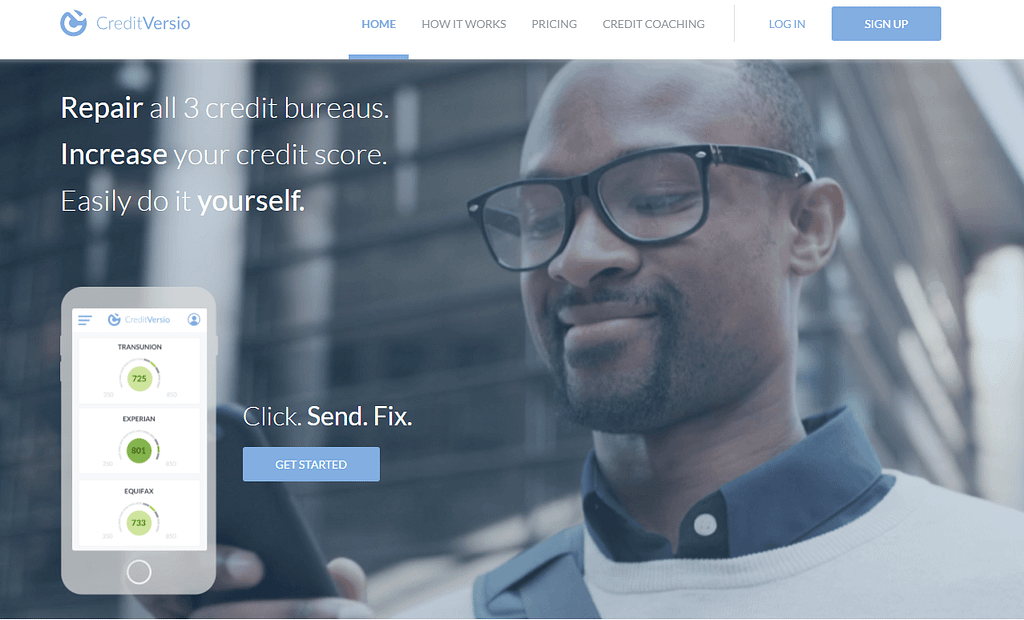

Credit Versio

Best for personal credit repair

Best for personal credit repair

Credit Versio is a credit counseling service that offers subscription-based access to its credit repair software. Only individuals can use this service; there are no business subscription options.

Their subscription plans provide access to unlimited disputes, letter templates, and a custom dispute strategy.

They have also partnered with existing credit monitoring services SmartCredit and IdentityIQ to offer their customers access to updated credit scores and reports every month.

One unique feature this company provides is a series of video tutorials that explain credit and credit repair. This is a fresh change from the article format that other companies use to present this information.

Credit Versio Pros & Cons

Pros

Pros

- Identity theft insurance with every plan

- Monthly credit scores and reports from all 3 bureaus

- Video credit coaching

- Unlimited disputes

Cons

Cons

- No free trial

- Only one individual account allowed

Credit Versio Cost

Credit Versio offers three subscription-based plans. All of their plans come with unlimited disputes and monthly credit scores, and reports from all three credit bureaus. All plans also feature credit monitoring for TransUnion.

The plans differ in the amount of identity theft insurance offered and how many credit score updates you have access to. These factors may or may not be important to you.

Keep in mind that identity theft insurance may only cover the cost of recovering from identity theft and, in some cases, actual damage from identity theft.

| Credit Versio Package | Basic | Premium | IdentityIQ |

|---|---|---|---|

| Price | $19.95/month | $24.95/month | $29.99/month |

| Identity theft insurance | $1 million | $1 million | $25k |

| Score refreshes | 2/month | unlimited | Not specified |

| Credit monitoring partner | SmartCredit | SmartCredit | IdentityIQ |

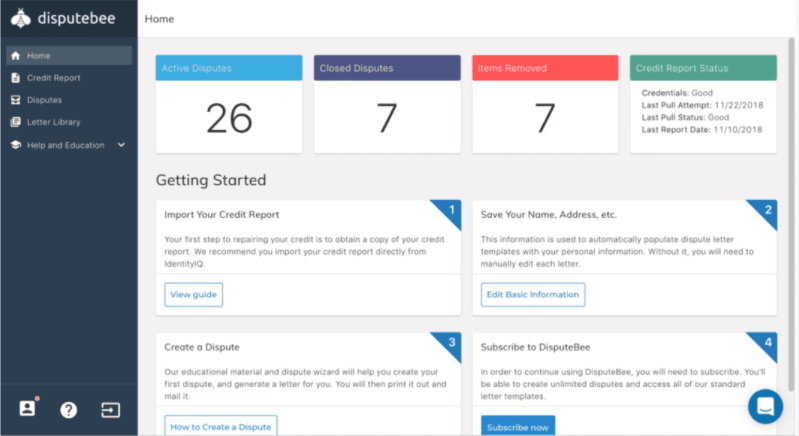

DisputeBee

Best for credit repair business client resources

Best for credit repair business client resources

The DisputeBee credit repair software is a tool available to both individuals and credit repair businesses.

Their model is subscription-based access to the software, which can be used to generate various dispute letters. These letters can be generated for collections, inquiries, late payments, etc. There is also an option to combine multiple account disputes into one letter.

Those with credit repair businesses can use DisputeBee’s software to manage the credit repair of an unlimited number of clients. And they get access to unique tools for managing their billing, contracts, and credit repair process.

DisputeBee Pros & Cons

Pros

Pros

- Affordable business subscription

- Tracks disputes

- Unlimited clients and team members

- Client portal

- Integration with billing and contracts

Cons

Cons

- No credit score change tracker

- No guidance on what you should dispute

DisputeBee Cost

There are only two pricing plans for DisputeBee’s software; one for personal use and one for business use.

The individual plan (personal use) costs $39/month. The features it offers include:

- Credit scores for all three bureaus

- Letter templates

- Generating dispute letters

- Tracking dispute progress

- Educational materials

The business plan includes all of the individual plan features, plus unique business features such as:

- Unlimited clients & team members

- Client portal

- Bulk letter generator

- Custom templates

- Billing integration

- And more

The Business Plan will set you back $99/month, which is pretty reasonable compared to other business plans.

Credit Repair Magic

Best for learning about credit repair

Best for learning about credit repair

Credit Repair Magic had its initial software offered in 1994, and the website looks like it hasn’t been updated since the 90s.

Besides the infomercial-looking website, the software itself is not technically software. Instead, the credit repair package you are paying for is more like self-guided instruction.

You get sample dispute templates but are encouraged to write letters yourself. You also get access to several pdfs and spreadsheets that explain the dispute process and help you track your disputes.

Because it is entirely self-guided, you can use the tools for yourself, your family, and even your friends.

If you are looking for a straightforward credit repair software solution, this package is not for you. But, if you want to tackle the dispute process yourself and learn a bit about credit repair and credit in general, then Credit Repair Magic could be a helpful tool.

Credit Repair Magic Pros & Cons

Pros

Pros

- Low one-time fee

- Money-back guarantee

Cons

Cons

- More of a do-it-yourself platform

- Involves lots of reading and spreadsheets

Credit Repair Magic Cost

Access to the Credit Repair Magic package costs a one-time fee of $97 plus tax. That’s all you’ll ever pay.

The package includes educational materials that detail the process of filing disputes, including how to find dispute-worthy items on your credit report. You also get access to several spreadsheets, calculators, templates, and other resources.

Credit Repair Magic offers a 60-day money-back guarantee. If you are not satisfied, contact them for a full refund.

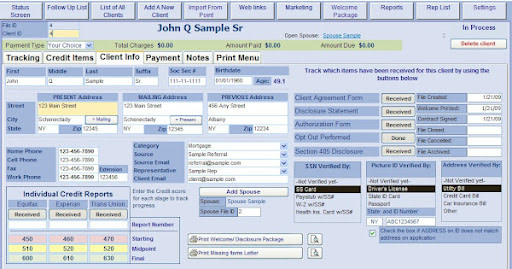

Credit Detailer

Low-cost option for credit repair businesses

Low-cost option for credit repair businesses

The Credit Detailer credit repair software is primarily sold to those in the credit repair business. However, they do offer packages to individuals as well. And unlike other services, Credit Detailer is sold for a one-time fee.

The software includes letter templates (disputes and more), educational resources, and progress tracking. The software’s professional (business) version comes with additional tools for marketing, invoicing, automated backup, and more.

Credit Detailer also offers add-on services, like credit coaching, technical support, additional licenses, etc.

The Credit Detailer software is a single computer download. While this can limit your flexibility, it can offer extra protection against cyber security threats. And despite being limited to one computer, the personal edition supports up to 2 users, and the professional edition supports unlimited clients.

Credit Detailer Pros & Cons

Pros

Pros

- Free demo & 30-day refund policy

- Credit coaching options

- Unlimited clients

- Bilingual software (Spanish & English)

Cons

Cons

- Expensive add-ons

- Limited to one PC

- No credit report integration

Credit Detailer Cost

The base price for the Credit Detailer professional software is a one-time fee of $399. Credit Detailer offers a variety of add-ons at different price points.

Credit Detailer Professional Package & Add-Ons

| Package/Add-On | Cost | Details |

|---|---|---|

| Professional Edition | $399 | 1 software license |

| Additional licenses | $249 | |

| Online portal | $499.99/year | For your clients to check case status |

| Live technical support | $60/hr | Must schedule appointment |

| Maintenance | $249.99 for 1 year $399.99 for 2 years $449.99 for 3 years |

Includes software upgrades |

Credit Detailer also offers several bundles, including professional bundles with multiple licenses and support and personal bundles with credit coaching included.

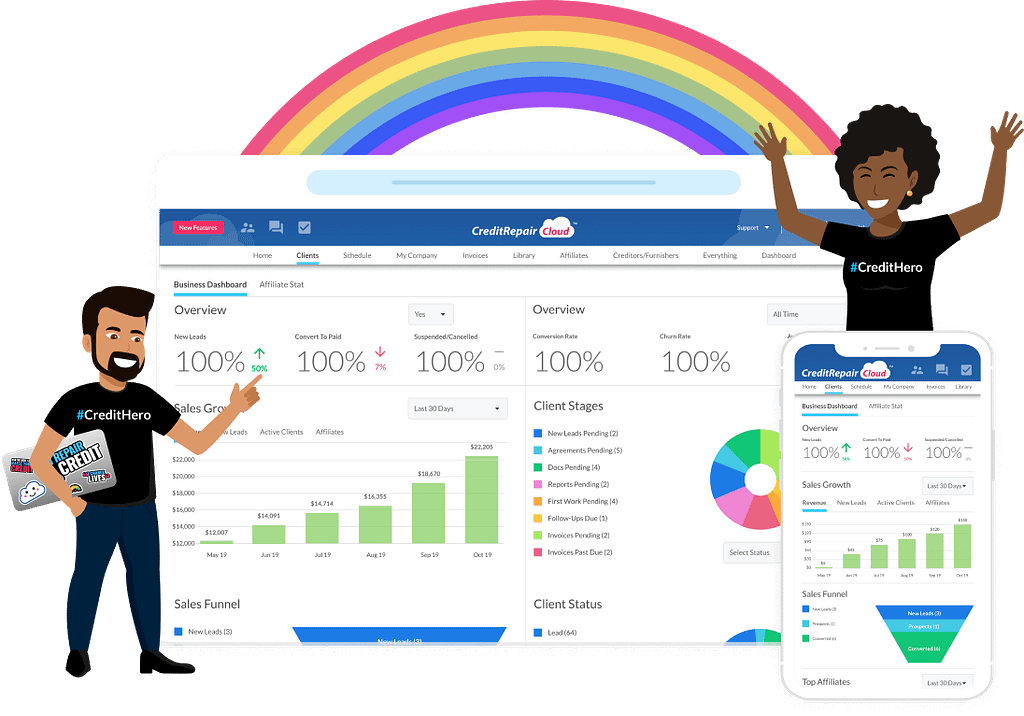

Credit Repair Cloud

Best for marketing and support

Best for marketing and support

Credit Repair Cloud offers its credit repair software strictly to credit repair businesses. Their model is subscription-based.

Their price points are rather high, starting at $179/month, but they provide more than just credit repair software.

In addition to letter templates and dispute tracking, Credit Repair Cloud’s subscriptions come with a client portal, KPI dashboard, CRM system, live support, education resources, and more.

This makes Credit Repair Cloud a complete business solution for someone launching a credit repair business.

Credit Repair Cloud Pros & Cons

Pros

Pros

- Full business software solution

- Savings offered on annual plans

- Unlimited storage

- Client portal

Cons

Cons

- High prices

- Does not offer unlimited clients or team members

Credit Repair Cloud Cost

Credit Repair Cloud offers four base plans and a few optional add-ons. All of their plans come with a set of core features, with the only difference between plans being the maximum number of clients and team members.

| Package | Price | Max Clients | Max Team members | Additional 100 clients | 1 Additional team member |

|---|---|---|---|---|---|

| Start | $179/month | 300 | 3 | $50/month | $50/month |

| Grow | $299/month | 600 | 6 | $40/month | $40/month |

| Scale | $399/month | 1200 | 12 | $30/month | $30/month |

| Enterprise | $599/month | 2400 | 24 | $20/month | $20/month |

Credit Repair Cloud offers a 20% discount if you sign up for an annual plan, and they offer a 30-day free trial.

Comparing Credit Repair Software

Here is a side-by-side comparison of the 5 credit repair software packages we discussed above. We focus on the key points you need to compare when shopping for credit repair software.

| Software Company | Package Types | Cost | Credit report integration | Costly add-ons | Coaching Services | Max number of accounts/clients |

|---|---|---|---|---|---|---|

| Credit Versio | Individual | $19.95 – $29.99/month | Yes | No | Video only | 1 |

| Dispute Bee | Individual & Business | $39/month individual or $99/month business | Yes | No | No | Unlimited |

| Credit Repair Magic | Individual | $97 one-time fee | No | No | No | Unlimited |

| Credit Detailer | Business & Individual | $399 one-time fee | No | Yes | Yes, for a fee | Unlimited |

| Credit Repair Cloud | Business | $179 – $599/month | Yes | Yes | No | 2400 |

What You Need to Know When Shopping for Credit Repair Software

The most important thing to keep in mind when shopping for credit repair software is that credit repair software and credit repair services are not the same.

Credit repair services are governed by the Credit Repair Organizations Act (CROA), which regulates how a credit repair company can operate. This includes informing you of your rights, not making false promises, and not charging you until services are performed.

Personal credit repair software doesn’t necessarily have to abide by these laws. Instead, they can charge you upfront for the software, and it is up to you, the consumer, to know your rights.

Something else to keep in mind with credit repair software is that all of the processes it offers to help you with are things you can do yourself for free. This means that the software needs to save you time to be valuable. So it is important to evaluate the software accordingly.

For instance, software packages that are not integrated with your credit reports will require you to manually enter the accounts you are disputing and all the details of the dispute.

If you’re comparing plans offered by a credit repair software provider, be sure to weigh the plans against your personal needs. If your credit challenges are relatively simple a premium plan may cost you more money without delivering any extra value.

If you’re comparing plans offered by a credit repair software provider, be sure to weigh the plans against your personal needs. If your credit challenges are relatively simple a premium plan may cost you more money without delivering any extra value.

If you are a credit repair business looking for software, your key questions when shopping should be

If you are a credit repair business looking for software, your key questions when shopping should be

- How many clients does it support?

- How many team members does it support?

- Are there storage limitations?

- Do I need additional business services (i.e., marketing tools)?

Some credit repair software packages for businesses are designed for keeping client records and filing disputes. In contrast, others offer in-depth credit repair business tools outside of just filing disputes.

How We Chose the Best Credit Repair Software

When comparing these 5 credit repair software options, we looked closely at a select set of criteria. With these 5 companies offering very different products, these criteria helped us narrow down where some software packages excelled, and others fell flat.

Below is a summary of the criteria we used and how we applied them when comparing software packages.

Best for Feature

What does this credit repair software do best?

While this criterion is largely subjective, we focused on the overall features of each software package to determine who and what it would be best suited for.

Service Type

Credit repair software has two main markets: personal (individual) and business. Most companies offer one or the other, but some offer both.

Even though a company might offer software packages to both individuals and businesses, it is still possible for one of those packages to be better than the other.

Cost and Value

Cost is key when shopping around for a product or service, but value is equally important is.

While the credit repair software options that we chose vary in price, they all offer a value that is in line with their price.

For instance, Credit Repair Cloud has a high monthly price, but the packages they offer come loaded with features to help support a business from launch through expansion.

Hands Off Versus Hands-On

Do you want to tackle the credit repair process yourself, or do you want a ‘click and done’ solution?

This is what we aim to answer in evaluating credit report integration. The software packages that integrate with credit reports allow customers to quickly find information and generate disputes.

The software packages that don’t allow for integration with credit reports require you to manually enter information and have a greater knowledge of the dispute process.

Additional Fees

Some software options on our list have straightforward pricing; either a flat fee or limited subscription options.

But other software companies on our list have complicated pricing, such as multiple subscriptions and optional add-on services. This can allow for customization of your software package, but the additional costs can add up.

This is why we felt it was important to detail the cost of the software and include these other potential budget-killers.

Coaching Services

One-on-one interaction with an expert is largely what separates credit repair software from credit repair services.

That said, a few of these software companies offer credit coaching services. This, more so than technical support, can help you utilize the software to its full capabilities.

Number of Clients Supported

For credit repair business owners, knowing the number of clients the software can support is critical. Can the software grow with you?

The business software options we covered in this article either offer unlimited clients or package options with increasing max client counts to support you as you grow.

Bottom Line

Credit repair is something you can tackle on your own, completely for free. But it can be confusing and takes up a significant amount of time.

On the other hand, credit repair services do all of the work for you but can also cost you a lot of time since you are not their only client.

Credit repair software is the in-between solution. You are in charge of the process, and disputes get filed according to your schedule.

Credit repair software can also save time for credit repair businesses. And the software solution can help them organize their files and generate new business.

Whether you are an individual or a business, when shopping for credit repair software, evaluate all the features and not just the price. That way, you know what you are getting and determine if it will suit your needs.

The post Best Credit Repair Software (2022) appeared first on FinMasters.