Cheese Credit Builder

Cheese can help place an installment loan on your credit record with no credit check. Cheese loans are inexpensive and can be an effective way to build credit if you manage them effectively, especially if you have no credit score or a thin credit file.

Pros

Reports to All Three Credit Bureaus.

No Admin or Membership Fees.

Get a Lump Sum When Your Loan is Paid.

No Credit Check.

Effective for establishing credit.

Cons

Limited refund if you cancel early.

Limited impact if you’re rebuilding damaged credit.

Previous products from the same company received negative reviews.

What is Cheese?

It’s not something you find on a cheeseburger. Cheese is a relatively new company that provides credit-builder loans. Credit score tracking and rent reporting services are expected to launch by the end of 2023, but for now, it’s all about the credit-builder loan.

Cheese is not a bank or a lender. Banking services and FDIC insurance are provided through Synapse, a banking software provider.

Cheese previously offered an online debit card account. This product was fully discontinued in December 2022, and the Company is now focused on credit-building products.

Cheese previously offered an online debit card account. This product was fully discontinued in December 2022, and the Company is now focused on credit-building products.

What is a Credit-Builder Loan?

A credit-builder loan is an installment loan that is designed to build your credit record.

Unlike a regular installment loan, you don’t get the money upfront. Instead, the money goes into a locked savings account. You make monthly payments, and when the loan is paid, the entire sum is released to you.

This arrangement almost completely eliminates risk to the lender because the money stays under their control until the loan is fully paid. That makes it possible for them to offer these loans to people with low credit scores or no credit scores.

A study by the Consumer Financial Protection Bureau (CFPB) found that credit builder loans can help build credit, especially for people without existing loans. Borrowers without existing debt increased their credit scores by 60 points more than those with existing debt.

The Risk

Like any form of credit, credit-builder loans are most effective if you make every payment on time. The CFPB study found that 39% of credit builder loan users made at least one late payment.

If you use a credit builder loan from any provider, it is critically important to make payments on time. Fortunately, these loans typically have low monthly payments.

Cheese will deduct your payment automatically from your linked bank account, but you’ll still have to be sure that you have enough money in the account to cover the payment.

How Does Cheese Work?

Cheese offers credit builder loans with terms of 12 and 24 months. A longer loan term will help you build your credit history. Your payments will be reported to the three major credit bureaus: Experian, Equifax, and TransUnion.

These are the plans Cheese currently offers.

| Loan Amount | Term (Months) | Monthly Payment |

|---|---|---|

| $500 | 12 | $44.42 |

| $500 | 24 | $23.54 |

| $1000 | 12 | $88.85 |

| $1000 | 24 | $47.07 |

| $2000 | 12 | $177.70 |

| $2000 | 24 | $94.14 |

Late or missed payments can harm your credit, so choosing a plan with a low monthly payment will generally be a good idea.

Late or missed payments can harm your credit, so choosing a plan with a low monthly payment will generally be a good idea.

The process of using Cheese is as simple as eating cheese.

- Download the Cheese app. There are versions available for Android and iOS.

- Choose your plan.

- Fill in your name, phone number, address, birthday, and Social Security number.

- Link your bank account.

- Apply for a loan. There’s no credit check.

- Cheese will debit your payments directly from your linked bank account. You can’t forget and accidentally make a late payment.

- Get your money in a lump sum when the last payment is completed. Cheese will pay it directly into your linked bank account.

Not all of the money you pay will come back to you. Some will go to interest payments. A credit builder loan is still a loan, and it isn’t free.

Your interest rate will depend on the state you live in.

| State | APR |

|---|---|

| GA, IL, OH, WV | 5% |

| HI, PA, MA, TX | 9% |

| CA, NC, NJ, NY, SC, VA | 12% |

| AK, AR, AZ, CO, CT, DC, DE, FL, IA, ID, KS, LA, MD, MW, MI. MN, MO, MS, MT, NE, ND, NH, NM, OK, OR, RI, SD, TN, UT, WY | 16% |

Cheese credit builder loans are not available in AL, IN, KY, NV, PR, VT, VI, WA, or WI.

Cheese credit builder loans are not available in AL, IN, KY, NV, PR, VT, VI, WA, or WI.

Cheese uses Finicity, a provider similar to Plaid, to connect to your bank account. You must use a bank or credit union that is compatible with Finicity to use Cheese. You can search this list to see if your bank or credit union is supported.

Cheese uses Finicity, a provider similar to Plaid, to connect to your bank account. You must use a bank or credit union that is compatible with Finicity to use Cheese. You can search this list to see if your bank or credit union is supported.

Requirements

Cheese credit builder loans do not require a credit check or even a credit score. There are still some requirements.

- You must be over 18 and a citizen or legal resident of the US with a valid Social Security number.

- You must live in a state where Cheese provides service.

- You must have an internet connection and an Android or iOS device capable of running the Cheese app.

- You must have a verifiable email address, phone number, and street address.

- You must have a bank account that is compatible with Finicity that you can link to Cheese.

If you meet these requirements, you should be eligible for a credit-builder loan.

Paying Your Loan

You do not have to send your payment to Cheese. They will deduct it from your linked bank account. You will receive an email reminder three days before the scheduled payment.

If your account does not have sufficient funds, Cheese will not report a late payment immediately. They will contact you and try to work out a payment schedule. If you cannot pay, you will have the opportunity to close the account without penalty.

If you ignore the payment and do not close the account, a late payment will be recorded on your credit record, which will harm your credit.

Chees will not charge a fee if your account has insufficient funds, but your bank may charge an overdraft or insufficient funds fee. These fees can be substantial. Be sure you have enough in your account to cover the payment.

The default payment date is the business day after you open your account. If you are opening a Cheese account, plan ahead and open it at a time of the month when you typically have money in the account, like after a payday.

The default payment date is the business day after you open your account. If you are opening a Cheese account, plan ahead and open it at a time of the month when you typically have money in the account, like after a payday.

Closing Your Account

You can close your Cheese account at any time. The account will be listed as closed and fully paid on your credit report. You won’t get continuing credit score benefits, but your credit won’t be harmed.

The money you have paid into your Cheese account will be paid into your linked bank account minus interest.

It’s important to note that while your monthly payment is fixed, the percentage devoted to interest is not. Your early payments bias heavily toward interest, while later payments are almost entirely devoted to the principal. This is a common arrangement among credit-builder loan providers.

It’s important to note that while your monthly payment is fixed, the percentage devoted to interest is not. Your early payments bias heavily toward interest, while later payments are almost entirely devoted to the principal. This is a common arrangement among credit-builder loan providers.

What this means in practice is that if you close your account early, you’re likely to get back substantially less than what you paid in because a larger portion of those early payments went to interest. Be aware of that if you’re considering canceling.

How to Use Cheese

Credit-builder loans can be an effective way to build credit. That doesn’t mean they will be equally effective for all users. It’s important to know how to use a credit-builder loan and whether you’re a good candidate for one.

Credit-builder loans are most effective if you have a thin credit file or no credit score at all. If you’re in this position, a credit-builder loan is a convenient and affordable way to put an installment loan on your credit record.

You should pay attention to your credit mix. Credit scoring models reward you for having both installment loans and revolving credit (credit cards) on your record.

If you already have an installment loan (like a student loan), but you don’t have a credit card, a secured credit card might be your best credit-building option. Users with a credit card but no installment loan will get the maximum benefit from a credit-builder loan.

If you have nothing in your credit file at all, a secured credit card and a credit-builder loan make a great combination.

If you have nothing in your credit file at all, a secured credit card and a credit-builder loan make a great combination.

If your credit record is already full – for example, if you’re trying to recover from serious credit damage – a credit-builder loan will be less effective. It will help as long as you make all payments on time but don’t expect a dramatic impact. You might be better off focusing on managing your existing accounts well.

Customer Reviews

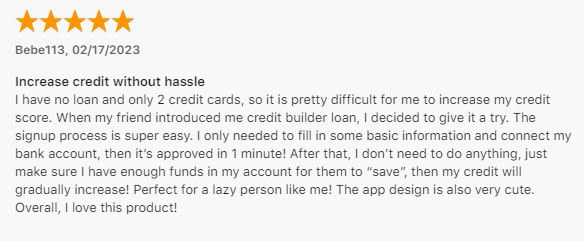

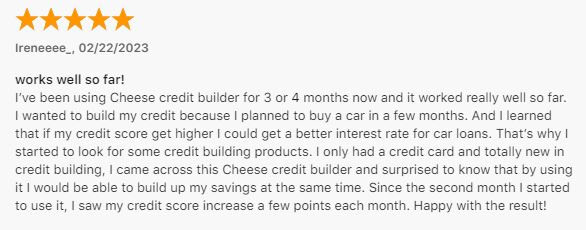

Interpreting Cheese customer reviews is tricky because many of the existing reviews are based on the Cheese online debit card account, which is no longer offered. We need to focus on the reviews that deal with the credit-builder loan.

Cheese gets 4.6 of 5 stars on the Apple App Store page. Negative reviews are primarily aimed at the debit card account. Reviews of the credit builder loan product are generally positive. These are some examples.

Cheese gets 3.5 of 5 stars from 887 reviews on the Google Play Store. Again the negative reviews are primarily based on the online debit card.

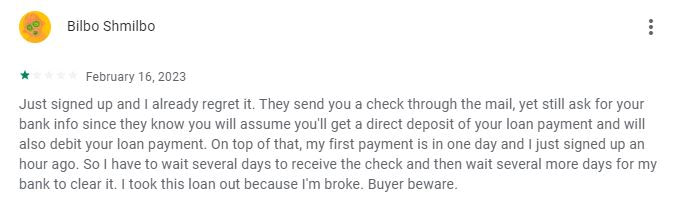

There are negative reviews of the credit-builder loan product, but some of them highlight a common problem with online reviews of financial products, Here’s an example.

The reviewer clearly has no idea how a credit-builder loan works or what he signed up for. He’s disappointed, but it’s not a problem with the product. The lesson here is to be sure that you understand the product before you sign up!

Cheese is not accredited by the Better Business Bureau (BBB) and has an F rating. Again, all of the complaints relate to the now-closed online debit card account.

The Bottom Line: Is it Worth It?

Credit-builder loans are an effective and affordable way to place an installment loan on your credit record. If you have a thin credit file or no credit record, they can help you establish a credit history.

Cheese offers a straightforward, basic credit-builder loan product. If you have decided on a credit-builder loan, it is certainly worth considering.

Some competitors may offer a wider range of options and other products, but that is only a factor if those options and products fit your needs. As with any financial product, the key is to identify your needs and select products that meet them.

Check out our review of the best credit builder loans to see how Cheese stacks up.

Check out our review of the best credit builder loans to see how Cheese stacks up.

How We Review the Products in This Category

We rate products by comparing them to similar products. In this case, that means compared to other credit builder loans and, to a lesser extent, to other credit-building tools. Here’s a summary of the rating criteria.

Effectiveness

This is based on the number of credit bureaus reported to, the type of account reported, and the length of history provided. Cheese reports an installment loan to all three major credit bureaus for a relatively high score, reduced only for a potentially short loan term.

Cost

Building credit doesn’t have to cost money. Credit-builder loans can run up substantial interest expenses and generally get mediocre marks in this category.

Ease of Use

Ease of use is primarily determined by user reports from customer reviews. This is slightly tricky, as the Cheese credit builder loan is a relatively new product, and many reviews deal with older products that have been discontinued.

Reviews of the credit-builder loan product generally indicate that the system is easy to set up and manage.

Support

Support scores are also based largely on customer reviews. All products have some issues, and you want to be sure that you can get quick and effective solutions if something goes wrong. Reviews indicate some customer service issues with Cheese. These may be partly due to misunderstanding or unreasonable expectations on the part of some users, but there’s still cause for concern.

The post Cheese Credit Builder Review 2023: Build Credit and Savings appeared first on FinMasters.

FinMasters