Credit repair doesn’t have to be difficult. With a little bit of time and effort you can repair your credit yourself. Credit repair software can help. In this review we’ll look at the software offered by Credit Detailer to determine if it is a good resource for your credit repair journey.

Credit Detailer Review & Ratings

Credit Detailer Review

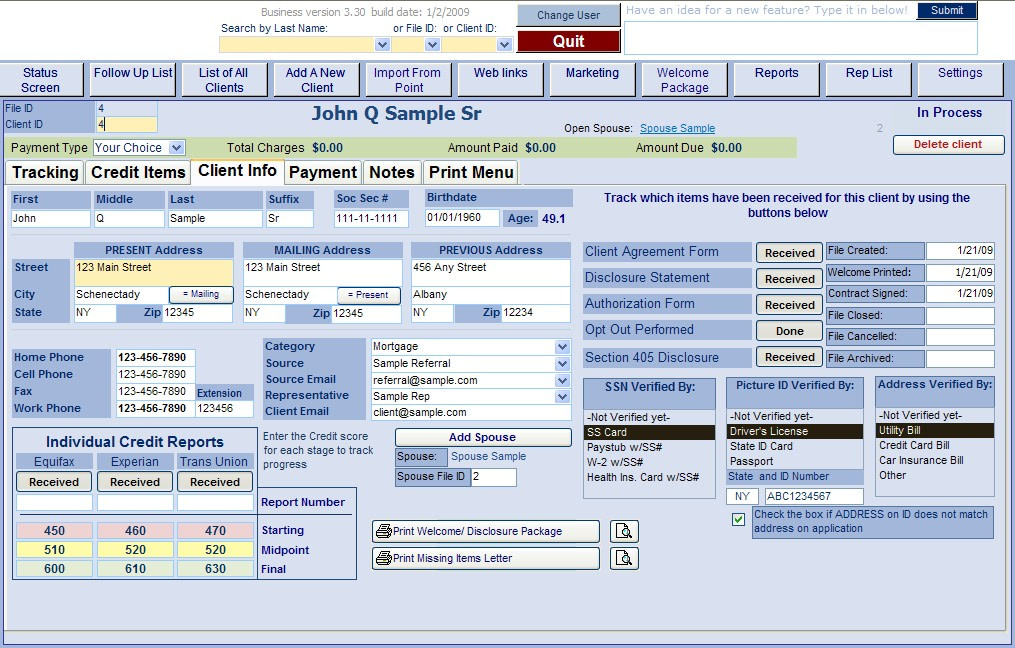

Credit Detailer software’s comes in two versions; one for individuals and one for credit repair businesses. Both come with the same dispute letter generating and tracking features.

The professional (business) edition also comes with tools for managing clients, marketing, and billing.

Pros

Bilingual

Good price

Better information security

Cons

Difficult to use

No app integration

Extra fees for add-on services

What is Credit Detailer?

Credit Detailer offers credit repair software packages to individuals and credit repair businesses.

This software helps streamline the process of filing disputes by generating and printing dispute letters. The color-coded display for client accounts and dispute tracking can help keep things organized.

While Credit Detailer offers its software to individuals and businesses, its primary focus appears to be selling to credit repair businesses. Their professional software includes features for managing unlimited clients, invoices/billing, marketing materials, access to a client portal, and more.

Their personal credit repair package is the same software with the client management features removed.

The price point is low (for a business), but many of the software’s features are antiquated. There is no way to integrate with common billing and bookkeeping apps, nor can you import credit reports. This is understandable, considering the software was created in 2007 and last updated in 2019.

The price point is low (for a business), but many of the software’s features are antiquated. There is no way to integrate with common billing and bookkeeping apps, nor can you import credit reports. This is understandable, considering the software was created in 2007 and last updated in 2019.

But it begs the question, is Credit Detailer still a viable option for credit repair businesses?

How Does Credit Detailer Work?

The credit repair software offered by Credit Detailer is in a downloadable format restricted to one computer. This can boost your information security but also limits your flexibility.

To begin using Credit Detailer, you’ll need to purchase and download the software. As part of the initial purchase, you’ll also receive 30 minutes of help installing and setting up the software.

How to Sign Up for A Free Trial

Credit Detailer gives you the option to try out their software before you buy. While this trial is limited to demo data, it can still be an excellent resource for researching whether or not Credit Detailer will work for you.

To begin, select Download Free Trial from the Credit Detailer website. This downloads a zip file to your computer.

Double-clicking the file will start the installation process. Once installation is complete, you’ll be able to open the program using Microsoft Access. Warning, this program cannot be run with newer versions of Access. Credit Detailer recommends the 2013 version.

You can now begin exploring the features of the Credit Detailer software, but some features will be locked.

You can unlock some of these features by activating your free trial using the current access code (DEMOCODE22) and your email address. This gives you full program access for 7 days.

You can unlock some of these features by activating your free trial using the current access code (DEMOCODE22) and your email address. This gives you full program access for 7 days.

How to File Disputes

Once you’ve purchased the Credit Detailer software, you can begin using it to file and track disputes.

Below is a summary of how to begin filing disputes.

Step 1: Obtain your credit report(s).

Credit detailer does not offer any kind of credit report or score resources. You’ll need to obtain copies of your credit reports on your own.

Step 2: Enter credit items.

Once you have your credit reports, you’ll need to enter the negative items into Credit Detailer’s software manually. This includes providing creditor names, account numbers, type of negative remark, and more.

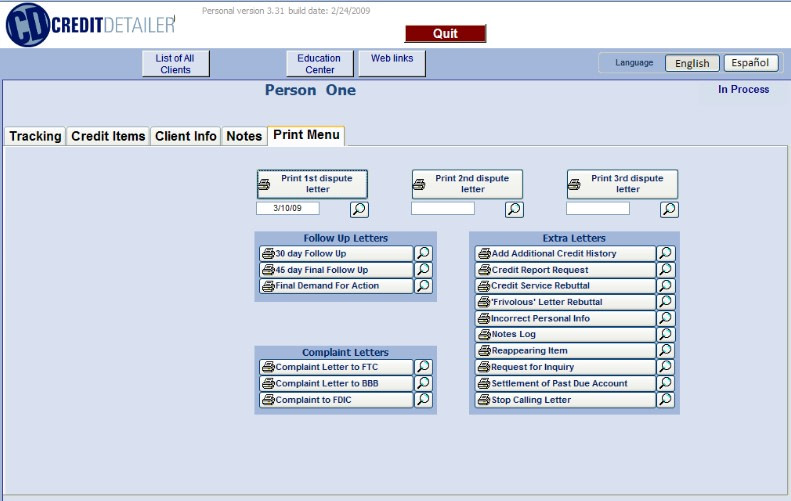

Step 3: Generate dispute letters.

On the Print Menu tab, you’ll have the option to print 1st, 2nd, and 3rd dispute letters. You can enter a date and bulk print letters for all your credit items. Once printed, you’ll need to physically mail the letters.

How to Manage Your Clients

The basic dispute creation process works the same as it does for the personal credit repair package. You can add credit items, print dispute letters, and track disputes. But there are additional features and tools geared toward helping you manage your clients.

You can use the List of All Clients feature to view/sort/search through your list of clients. Selecting a client will let you view their personal information, credit information, payment information, active disputes, and custom printing options.

Using the Follow Up List feature, you can quickly locate client accounts that require actions (i.e., needing the next set of dispute letters, follow-up letters, etc.).

You can add new clients using the Add A New Client feature.

And if you want to view stats on your clients/business, information like where your clients were referred from or how many have unpaid balances, you can use Credit Detailer’s custom Reports feature.

For more info on using the Credit Detailer professional software to create new client profiles and manage their credit items, check out this YouTube video.

Additional Features Offered by Credit Detailer

Most of the features available through Credit Detailer’s software deal with dispute creation and tracking or managing credit repair clients. But, the company does offer a few extra features.

For the personal credit repair software, Credit Detailer gives you the option of purchasing coaching sessions. These sessions range from 1 hour up to 3 hours of coaching. These expert coaches can help you navigate the Credit Repair software and avoid the common pitfalls of credit repair. That said, these coaching services are not free.

Credit Detailer provides access to their education center full of credit repair guidance, tips, and tricks at no extra cost.

The professional version of Credit Detailer comes with the education center, support of unlimited clients, and a custom report generator, but there are some additional add-on features (for a fee).

- Technical support – schedule a call with a technical support specialist.

- Upgrades – update your software as changes are released.

- Status portal – a feature that allows your clients to view the current status of the disputes you have filed on their behalf.

As an additional feature, both the personal and professional software packages are available in English and Spanish.

Credit Detailer Pricing

Credit Detailer’s pricing is a bit complicated with their bundling and add-on services.

For those looking for personal credit repair, there are two packages to choose from:

| Bundle #1 | Bundle #2 |

|---|---|

| Software + 1 hour of expert coaching | Software + 3 hours of expert coaching (divided up over 4 months) |

| $399.99 | $499.99 |

In contrast, the base professional software costs a one-time fee of $399. It supports unlimited clients and comes with 30 minutes of installation support.

But beyond this base software, Credit Detailer offers a host of add-on services and bundles.

For credit repair businesses, there are 3 bundles:

| Bundle #1 | Bundle #2 | Bundle #3 |

|---|---|---|

| Professional edition for 1 computer | Professional edition for 3 computers | Professional edition for 3 computers |

| Plus 6 hours of expert coaching | Plus 3 hours of expert coaching | Plus 10 hours of expert coaching, website setup, & LLC paperwork |

| $1299.99 | $1499.99 | $5999.99 (extra $1000 fee for non-profits) |

Credit detailer does offer the option to pay for these packages on an installment basis for a $9.99 one-time fee.

Credit Detailer also offers several add-on services to go with their professional software.

| Additional licenses | $249/each |

| Online status portal | $499/annually |

| Technical support | $60/hour |

| 1-year maintenance & upgrade plan | $249.99 |

| 2-year maintenance & upgrade plan | $399.99 |

| 3-year maintenance & upgrade plan | $449.99 |

Credit Detailer does offer all potential customers a free trial. This free trial lets you explore many of the software’s features but only using testing (fake) data.

If you decide to move forward with purchasing the software but end up unhappy with the features or functionality, Credit Detailer offers a 30-day refund with “no questions asked”.

Credit Detailer Customer Reviews

What do the customers think of Credit Detailer’s software?

Credit Detailer posts several testimonials on their website. But like any company selling a product, they only post positive reviews, no negative ones.

Interestingly, the most recent review on the testimonials page is 4 years old, with most of the reviews dated between 2008 and 2010.

Credit Detailer has no BBB page, no Trustpilot reviews, and zero reviews on Google. Their Facebook page has exactly two posts from 2016 and zero engagement.

Even their YouTube channel seems to have stagnated with the last video posted in 2019 with the comments turned off. One video posted in 2008 seems to have some credible reviews, including this one about their personal credit repair software.

Considering the age of existing reviews/testimonials and the general lack of reviews (negative or positive), this brings up doubts on whether this software is still in widespread use.

Considering the age of existing reviews/testimonials and the general lack of reviews (negative or positive), this brings up doubts on whether this software is still in widespread use.

Credit Detailer Alternatives

To see how Credit Detailer matches up to the competition, below is a table comparing them to three credit repair software alternatives.

| Type of Service | Features | Effort Involved | Cost | |

|---|---|---|---|---|

| Credit Detailer | Software for credit repair businesses and individuals | Generate dispute letters, track disputes, manage clients, and dispute status client portal | Very High | $399 with optional add-on services |

| Dispute Bee | Software for credit repair businesses & individuals | Credit scores, letter templates, and dispute tracking. Plus client portal and billing integration | Medium | $39/month + $21.99/month(personal) $99/month (business) |

| Credit Repair Magic | Credit repair system | Letter templates and education resources | Very High | $97 |

| Credit Repair Cloud | Software for credit repair businesses | Import credit reports, generate disputes, app integration, and client portal | Low | $179 – $599 a month plus fees for adding more clients/team members |

Credit Detailer publishes their own list of their competitors, links to their websites, their prices, and contact information. This can be useful when researching and comparing credit repair software companies.

You can also check out our roundup of the best credit repair software options.

You can also check out our roundup of the best credit repair software options.

So, how does Credit Detailer stack up against the competition?

Their price point is on the lower side. A one-time fee of $399 for a lifetime license is much cheaper than companies charging $100 monthly. But the features of Credit Detailer’s software are a bit lacking. While they offer unlimited clients, you are charged $200+ for each additional download.

Alternatively, most of the cloud-based software options offer unlimited team members.

Also, Credit Detailer has minimal marketing, billing/invoice, and credit monitoring tools. The newer competition offers a wider range of tools and services to credit repair businesses.

Is Credit Detailer Worth It?

Credit Detailer’s one-time fee might be a worthwhile solution if you are considering launching a small credit repair business. The system supports unlimited clients and provides educational resources that are useful for getting your business off the ground.

Later, if you decide to grow your business and hire more staff, the fees for additional licenses might become a problem.

Additional users who might find Credit Detailer’s software a good investment include:

Additional users who might find Credit Detailer’s software a good investment include:

- Those with concerns about the information security of cloud-based options.

- Spanish speakers with a credit repair business (software is bilingual).

- Credit expert looking to help family and friends repair their credit (will need professional version, personal version is limited to 2 profiles).

Unfortunately, Credit Detailer is not going to be a good fit for credit repair businesses that:

Unfortunately, Credit Detailer is not going to be a good fit for credit repair businesses that:

- Have a lot of employees

- Want an all-one solution

- Operate from tablets and mobile devices

- Desire an automated process for disputes

With the requirement of manual credit item entry, Credit Detailer is also a poor choice for those wanting to repair their own credit.

Verdict

If you are looking for a solution to repair your own credit, skip Credit Detailer. With its low price, single download style, and support of unlimited clients, the software that Credit Detailer offers is best suited to owners of small credit repair businesses.

The high price for additional features, antiquated manual entry process, and lack of integration options make this software a poor choice for just about everyone else.

If you are considering Credit Detailer as a credit repair software solution, we highly recommend that you do your research on the competition first. There are newer software options (cloud-based and downloads) that offer many additional tools, integration options (i.e., QuickBooks, USPS shipping, etc.), and automation.

How We Review the Credit Repair Software

We rate all the products we review using a key set of criteria. This allows us to fairly compare products that are not identical.

These are factors we looked at when evaluating credit repair software.

Ease of Use: Is the credit repair software easy to use and navigate?

Credit Detailer’s software is not the easiest to navigate.

For personal users, manually entering credit items makes this software prohibitively difficult to use for anyone but credit repair experts.

For professionals, the software may become easier to use with repetition, and the custom reports and color-coded accounts can be helpful. But the lack of integration with other services for billing, marketing, and credit monitoring seriously hurt the software’s usability.

Effectiveness: Does the software deliver on its promise?

The lack of reviews, good or bad, makes it difficult to determine the true effectiveness of this product; instead, we had to evaluate the potential effectiveness.

The fact that the software supports unlimited clients and is offered in Spanish and English are positives for the potential effectiveness of this software.

But the manual entry style of filing disputes make this software time consuming and difficult to use. And their limited credit repair templates could potentially limit credit repair success.

Support: When you encounter problems with the software, is someone available to help?

Credit Detailer does have good customer service and tech help. They freely post their contact information, and many of their own testimonials cite excellent customer support.

Credit Detailer loses a few points on support simply because tech calls need to be scheduled ahead of time and require you to pay a separate fee.

Cost: Is the software affordable when evaluating all of the features?

Yes, the one-time cost of $399 is very affordable. Especially when compared to the subscription-based options. But the features of the software are a bit lacking.

The lack of features and the nickel-and-dime style of charging for additional licenses and tech support earned Credit Detailer a 6 in the Cost category.

The post Credit Detailer Review 2022: Software for Experts appeared first on FinMasters.

FinMasters