Credit My Rent is a paid rent reporting service that helps consumers build credit by sharing their ongoing and historical rent payments with two of the major credit bureaus. It requires an initial approval from your landlord, but not their continuing participation.

This Credit My Rent review will explore how their services work and help you decide whether they’re worth purchasing.

Credit My Rent Review & Ratings

Credit My Rent

Credit My Rent reports your monthly rent payments to the credit bureaus, helping you build credit. In addition to their ongoing subscription, you can also purchase up to two years of historical rent reporting.

Credit My Rent isn’t the worst rent reporting service available, but you can probably do better.

Pros

Intuitive user interface

Limited landlord involvement required

Cons

Hard to reach customer support

Only reports to two credit bureaus

Late payments will be reported

Limited customer reviews available

What is Credit My Rent?

Credit My Rent is a rent reporting service that shares your monthly lease payments with Equifax and TransUnion to help build your credit. If you make your rent payments on time, using their service may positively impact your scores.

Unfortunately, FICO Score 8, the most popular credit score, won’t factor in reported rent payments. However, VantageScores and FICO Score 9 will. As a result, reporting rent will become more valuable as lenders switch to the newer score versions.

Learn More: Contrary to what you might expect, you have far more than one credit score. Here’s what you should know about the many credit score versions: Types of Credit Scores: How Many Different Credit Scores Are There?

Learn More: Contrary to what you might expect, you have far more than one credit score. Here’s what you should know about the many credit score versions: Types of Credit Scores: How Many Different Credit Scores Are There?

Notably, adding rent to your credit report can be beneficial when applying for a loan, even if it doesn’t affect the score your prospective lender uses.

For example, mortgage underwriters review your credit report in addition to checking your score. A history of timely rental payments close to your mortgage amount can strengthen your application.

For example, mortgage underwriters review your credit report in addition to checking your score. A history of timely rental payments close to your mortgage amount can strengthen your application.

How Does Credit My Rent Work?

Here’s everything you need to know about how Credit My Rent’s services work, including how to sign up for them, how you report your rent payments, and how much they’ll cost you.

How to Sign Up

To sign up for Credit My Rent, you must enroll through their website, as they don’t have a mobile application. Fortunately, the interface is surprisingly user-friendly, and you should be able to complete the application in a few minutes.

During the enrollment process, you’ll need to provide your personal contact information, lease details, and landlord’s contact information. Credit My Rent will then verify your address and account info through their national database.

Next, they’ll email a link to your landlord to verify your lease details. Credit My Rent designed the process to minimize landlord involvement, so they only need to click a link and answer a few questions about your lease, and then you can get started.

Fortunately, Credit My Rent has no eligibility requirements. As long as you have current or previous rental payments in the United States, you can use their services to share your information with the credit bureaus.

How Credit My Rent Reporting Works

Once you’ve completed the initial sign-up process, you’ll have the opportunity to choose a rent reporting plan. Credit My Rent lets you report monthly payments only, monthly and one year of historical payments, or monthly and two years of historical payments.

Whichever you choose, Credit My Rent starts sharing your data with Equifax and TransUnion as soon as the verification process is complete and you link your checking account to your Credit My Rent profile. That’s the last step of the enrollment process.

Once that’s done, Credit My Rent’s algorithm can automatically verify your monthly rent payment by checking your financial transaction history. Neither you nor your landlord needs to do anything more each month to facilitate the reporting process.

If you buy historical reporting services, Credit My Rent will share the information on your first reporting date along with that month’s rent payment.

That should occur within three business days of completing the enrollment process. Subsequently, Credit My Rent claims that it usually takes between 15 and 30 days for the credit bureaus to update your credit report to reflect the data.

Credit My Rent may require monthly verification from your landlord to report your activities to Equifax if you pay your rent in installments throughout each month or use a payment method other than a single, consistent bank account.

Credit My Rent may require monthly verification from your landlord to report your activities to Equifax if you pay your rent in installments throughout each month or use a payment method other than a single, consistent bank account.

Will Late Payments Be Reported?

If you pay your rent more than 30 days after it’s due, Credit My Rent will report your late payment to the credit bureau. Since that could damage your score, it’s best to avoid rent reporting services if you fear you might have difficulty paying on time.

Note that your late payment terms with your landlord or property manager have no impact on your credit. For example, your property manager can charge you for paying late after three days, but you still won’t be late for credit purposes until 30 days.

Learn More: Even a single late payment can damage your credit score significantly. Check out some of our favorite ways to get late payments off your credit report early: How To Remove Late Payments From Your Credit Report In 3 Easy Steps.

Learn More: Even a single late payment can damage your credit score significantly. Check out some of our favorite ways to get late payments off your credit report early: How To Remove Late Payments From Your Credit Report In 3 Easy Steps.

How Much Does Credit My Rent Cost?

Credit My Rent offers historical and continuing rent reporting services. However, they structure their offerings so that you must subscribe to monthly reporting if you want to report your payment history. Here are the options available and their respective costs:

- Tier 1: $14.95 for monthly reporting

- Tier 2: $14.95 for monthly reporting and $99 for 1-year historical reporting

- Tier 3: $14.95 for monthly reporting plus $149 for 2-year historical reporting

Fortunately, Credit My Rent lets you cancel the monthly service whenever you want without penalty. As a result, you can always sign up for the ongoing subscription and cancel after the first month if you’re primarily interested in historical reporting.

How Much Will You Build Your Credit?

There’s no way to know how much using Credit My Rent will increase your credit score. Unlike other rent reporting services, they don’t disclose the average score changes that their users experience. In fact, they repeatedly emphasize that they don’t guarantee results.

However, the impact is most likely to be significant if you have a thin credit file and report two years of positive rental payment history. Conversely, you’ll see a weaker effect if you make one or more late payments, already have an extensive credit file, or lack rental payment history.

The unpredictability is compounded by the many other factors that have a higher impact on your credit than rent. There’s no way to know how they’ll change during your reporting period, which can camouflage or overwhelm any benefits you receive from Credit My Rent.

Credit My Rent Customer Reviews

Unfortunately, it’s hard to find quality customer reviews for Credit My Rent. They haven’t created a profile on many of the most popular platforms, suggesting they’re not particularly well-established yet. That might be because they’re relatively new, but they don’t confirm any details about themselves on their website.

Existing customer reviews for Credit My Rent are mixed but skew positive. They have a solid 4.1 out of 5 stars on Trustpilot based on 162 reviews.

Most reviewers that praise the business say that their rent showed up on their credit reports shortly after enrolling for their services, and their credit scores increased as a result. They also often compliment specific customer service representatives by name.

Meanwhile, those that leave negative comments usually do so because they’re frustrated by the time it took for their rental activities to show up in their credit files or by the apparent lack of impact on their credit scores.

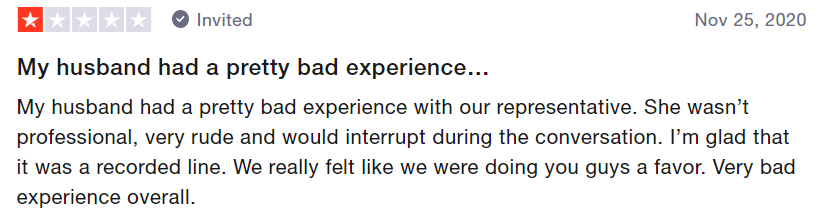

Displeased reviewers also reference poor customer service experiences. They report having difficulty getting someone to answer their calls or emails and state that any responses they received were rude or unprofessional.

Since there seem to be contradictory comments, I decided to try the service myself. Unfortunately, I encountered broken links that prevented me from initiating the enrollment process.

To get help with the issue, I sent Credit My Rent an email, tried to use their live chat, and called during business hours for several days but never received a response.

Take customer reviews with a grain of salt. Businesses can often falsify positive reviews or pay to eliminate negative ones. Conversely, customers are generally more inclined to leave negative comments when feeling aggrieved than positive ones when feeling pleased, which can skew results downward.

Take customer reviews with a grain of salt. Businesses can often falsify positive reviews or pay to eliminate negative ones. Conversely, customers are generally more inclined to leave negative comments when feeling aggrieved than positive ones when feeling pleased, which can skew results downward.

Credit My Rent Alternatives

Rent reporting services are becoming increasingly popular with each new credit score that considers your rental history. Landlords are learning that reporting rent gives them a competitive advantage over their peers, increasing the quality of the renters attracted to their properties and incentivizing them to pay on time.

As a result, there are many alternatives to Credit My Rent. Here are some of the others we recommend considering:

- Boom: An up-and-comer with a modern mobile app, Boom has much lower prices than competitors, reports to all three bureaus, and gives you the option to break up your rent payments into installments.

- Rent Reporters: One of the oldest surviving rent reporting services, Rent Reporters has flexible subscription options and a long-standing reputation for excellent customer service.

- Esusu Rent: Esusu is a landlord-sponsored reporting software that’s free for the renter. If your property manager adopts it, you can also apply for limited rental relief from Esusu.

| COMPANY | ONE-TIME FEE | MONTHLY FEE | CREDIT BUREAUS |

|---|---|---|---|

| Credit My Rent | FREE | $14.95 | TransUnion, Equifax |

| Rent Reporters | $94.95 | $9.95 | TransUnion, Equifax |

| Esusu Rent | FREE | $50/year | TransUnion, Equifax, Experian |

| Boom | $10 | $2.00 | TransUnion, Equifax, Experian |

When you’re comparing rent reporting service providers, make sure to consider more than their costs. For example, look at factors like the credit bureaus they report to, reviews regarding their customer support, and their historical reporting options.

Learn More: If you’re interested in a detailed explanation of the top rent reporters, read our guide to the most competitive options: 12 Best Rent Reporting Services In 2022.

Learn More: If you’re interested in a detailed explanation of the top rent reporters, read our guide to the most competitive options: 12 Best Rent Reporting Services In 2022.

Other Ways to Build Credit

Rent reporting can be a convenient way to supplement your credit-building efforts, especially since it doesn’t require that you take on any more debt. However, it’s not sufficient to develop a healthy credit file.

You’ll need to build credit in other ways to improve your score meaningfully, whether you use rent reporting services or not. Two great tools to start with are secured credit cards and credit builder loans. Both are accessible with limited or poor credit and help you develop the invaluable habit of saving money.

To qualify for a secured card, you must provide a cash deposit equal to your credit limit. Some consider that an obstacle, but a credit card will likely do more harm than good to your credit if you can’t afford to save a few hundred dollars for a deposit.

Similarly, a credit builder loan holds your loan proceeds in a locked savings account as collateral while you make your monthly payments. When you reach the end of the term, you’ll have built your credit and saved the loan’s principal balance.

Signing up for a secured card and a credit builder loan at the same time also diversifies your credit mix into revolving and installment debt. Since that alone is worth 10% of your FICO score, the two tools are highly effective in combination.

Learn More: If you’re looking for additional ways to build credit, check out some of our favorite strategies: Best Credit Building Tools of 2022

Learn More: If you’re looking for additional ways to build credit, check out some of our favorite strategies: Best Credit Building Tools of 2022

Is Credit My Rent Worth It?

Credit My Rent isn’t the worst rent reporting service available, but you can probably do better. Their customer support systems are lacking, their prices are average at best, and they only report to two of the three major credit bureaus.

As a result, you’re better off spending your money on a different rent reporting service. For example, Boom Report costs just $2 per month for ongoing reporting, receives excellent customer review ratings, and reports to all three credit bureaus. Alternatively, you could save your money and use it for a secured credit card deposit.

Our Methodology

The ratings we applied above are built on comparisons to other rent reporting services that compete with Credit My Rent. They are not intended to compare Credit My Rent to other types of credit-building tools.

Here’s an explanation of the rating criteria.

Cost

We compared the initial fee, monthly reporting fee, and past rent reporting fees with those of similar services. Credit My Rent’s costs are higher than those of several competitors, hence the reduced score.

Effectiveness

The primary criteria here are the number of credit bureaus reported to and the length of the credit history reported. Most rent reporting services will report up to two years of back rent, as Credit My Rent does. Credit My Rent reports to two of the three major credit bureaus, but two other entries in our database (Boom and Esusu Rent) report to all three.

Ease of Use

Ease of use is a measure of how easy the service is to set up and use. Credit My Rent has a simple website-based application process and many users report that it works well. Our experience and those of some other reviewers were less smooth.

Customer Support

No service goes right all the time, and when problems do arise you want to be able to get them addressed. Multiple reviewers reported service issues with Credit My Rent, and my own attempts to contact customer service yielded no result.

The post Credit My Rent Review (2022): You Can Do Better appeared first on FinMasters.

FinMasters