What makes one trading platform better than its competition? Is it the type of assets you can trade? The number and sophistication of its built-in analytical tools? Access to research? Proprietary ratings and analysis? Or is it something less tangible, some kind of secret sauce that you can’t quite put your finger on?

Whatever it is, clearly eToro is doing something right. Millions of people use their platform as their primary destination for all their trading needs, which is no easy feat in such a crowded market. So how good is eToro, really?

eToro

eToro is a mobile-focused, cryptocurrency-first trading platform. Its social media features, charts, and CopyTrader program are definitely worth a look, though it lacks in other areas. The relative lack of tradable stocks and ETFs, nonexistent analytical tools, and high crypto trading fees keep it from reaching the same heights as some of its competitors.

Pros

Intuitive Interface

CopyTrader and Popular Investor Programs

Good Social Media Features

Impressive Charting Functionality

Cons

High Crypto Fees

Few Stocks and ETFs

Lackluster Desktop/Browser Versions

No Real Analytical Tools

What is eToro, and Who is it For?

eToro is a mobile and browser-based trading platform with a focus on cryptocurrency and a few interesting community features. Its line of tradable cryptocurrencies, stocks, and ETFs makes it a solid choice for investors interested in trading those assets.

Several of eToro’s features seem designed for use by traders who are still learning the ropes. We’ll cover these later, as they’re major parts of eToro’s value proposition.

Tradable Assets

Here’s what you can trade with eToro.

Stocks

Traders who are okay with only trading on the NASDAQ and NYSE will find that eToro is a decent enough place to do it. You don’t have to pay any commissions on the purchase or sale of stocks, which is nice, though hardly unique these days.

When you access the stock page, you’ll see a few different filters to help you find the stocks or industries you’re looking for. The interface is built for visual clarity and ease of use, with a number of interactive tiles showing suggested stocks, lists of the day’s biggest movers, and some recommendations.

The recommendations come courtesy of both professional analysts (presumably aggregated from other firms) and via an “if you like X, then you might like Y” sort of system. It’s all fine if a little basic.

All in all, it’s pretty clear that stocks aren’t eToro’s main focus. In fact, stock trading seems more like an afterthought than a main feature.

ETFs

If stocks are something of an afterthought to eToro, ETFs barely qualify as a footnote. Not only is the ETF page just a list of names, prices, and daily price changes, the list itself is incredibly short.

According to Statista, there were something like 8,754 ETFs available globally in 2022[1]. Obviously, not all of them are American or even available from American markets, but if ETF.com is to be believed, there are still at least 1,782 American ETFs, or about 7 times as many as are available on eToro[2].

Options

If you want to trade options on eToro, you’ll have to download a separate app called eToro Options. As far as we can tell, there’s no browser or desktop-based version of eToro Options. Your regular eToro credentials work on the Options app, which makes the fact that they chose to make a separate app seem strange.

There are a few nice things about eToro’s options trading, even if the need to download a separate app is a bit inconvenient. eToro’s social features extend to the Options app, giving you a look at what trades are being made by other users so you can learn from their successes and mistakes.

The eToro Options app also lets you earn “eToro Options Rewards points” when you sign up, when you make your first deposit when you make (eligible) trades, and when you refer friends to the app. If that sounds interesting, well, hold on a second.

eToro Options Rewards Program

Let’s take a quick aside and talk about what the “rewards” program actually entails.

- Each point is worth $0.01, so 100 points equal $1.

- At the end of the month, earned points are converted to cash credits that can be put toward additional trades or withdrawn from your account.

Here’s how you earn rewards points and how many points each qualified action gets you:

- 500 points for Qualified Account Opening (opening an Options account with at least $5)

- Up to 5 points per qualified contract traded

- Doesn’t count low-cost contracts

- eToro can decide not to award you points if they feel they aren’t merited

- 500 points for Qualified Referrals

- Only awarded if the referred user maintains a positive account balance for over 30 days

- eToro can also decide not to award points for referrals

So, in other words, you get $5 for signing up, up to $0.05 for each contract you trade, and $5 for every friend you refer to the program. If eToro doesn’t find some reason not to give you the points.

It’s hard to imagine such small rewards being much of an incentive. You’d have to sign up at least one new friend and trade at least 30 contracts a month if you wanted to earn even $20 from the program.

Cryptocurrency

This is where eToro has put most of its energy. It only started supporting stock and ETF trading in America as of the end of 2022 (which helps explain the lack of securities and features) but it’s been a crypto broker for much longer.

It’s hard to tell how many different cryptocurrencies eToro supports, though it may be more a matter of user error than a problem with eToro’s interface. You’d think you’d get a list of all the available crypto if you click on the “View All” buttons above the Daily Movers, Trending Crypto, or By Market Cap lists on the Crypto overview page…but you don’t.

Clicking on the View All button above the Daily Movers list takes you to a page with 45 entries. The button above the Trending Crypto list turns up a page with 36 entries. The Market Cap list returns 54 entries. If you go to a completely different page that you navigate to via the Help menu, you’ll find a list of 80 cryptocurrencies. We assume that the latter number is correct, though that’s meeting eToro more than halfway.

In any case, it seems like eToro prefers to stick to the biggest names in crypto. They have Bitcoin and Ethereum, of course, as well as Dogecoin and Litecoin, but you’ll have to look elsewhere for the small and no-name currencies.

In any case, it seems like eToro prefers to stick to the biggest names in crypto. They have Bitcoin and Ethereum, of course, as well as Dogecoin and Litecoin, but you’ll have to look elsewhere for the small and no-name currencies.

Unlike the other assets you can trade on eToro, cryptocurrency trades come with a fairly substantial set of fees. The pricing isn’t exactly straightforward, either.

Each trade costs:

Each trade costs:

- 1% of the transaction

- Plus, the spread price of the crypto asset, calculated at the time of the execution of the order

It seems like every party to every transaction will pay fees of at least 1% of the overall transaction costs.

For comparison, a trade of less than $10,000 on Coinbase will incur a 0.6% maker fee and a 0.4% taker fee. That might not seem like a big difference, but those fees add up over time.

For comparison, a trade of less than $10,000 on Coinbase will incur a 0.6% maker fee and a 0.4% taker fee. That might not seem like a big difference, but those fees add up over time.

Research and Analysis

Before we get into eToro’s big features, let’s talk a bit about the research and analysis features available to you on the platform.

Research

eToro doesn’t have a whole lot of formal research available on the platform. You can find some news stories aggregated in the news tabs of most of the stocks and cryptocurrencies, though it’s pretty basic/general stuff for the most part.

You’ll also find all the standard fundamental information you’d expect from any trading site/platform for all the stocks and ETFs available on eToro. Most of it is pretty basic – financial information, market caps, a few different ratios, a bit of historical data, etc. – though they have recently added ESG analysis to some of the pages.

Some of the stocks, ETFs, and cryptocurrencies also have varying amounts of professional analyses attached to their pages. The quality and amount of that analysis are fairly inconsistent.

Tools

eToro doesn’t have any big, impressive analytical tools on its platform. There are no stock screeners, no flashy or in-depth portfolio analysis, and none of the stuff you’d expect to see on a platform this big.

eToro doesn’t have any big, impressive analytical tools on its platform. There are no stock screeners, no flashy or in-depth portfolio analysis, and none of the stuff you’d expect to see on a platform this big.

The one thing eToro does have going for it is a fairly advanced charting feature. Again, it isn’t going to be breaking any records or blowing any minds, but it’s effective enough. In addition to the standard set of selectable time frames and the ability to zoom in and out, each chart has a fairly long list of customization options.

There are a few different chart types like line, candle, area, bars, and so on, as well as a pretty expansive list of options for changing the color and appearance of the chart. You can also add at least one more symbol/asset to your chart for the sake of comparison.

If you’re a stock trader, you’ll be pleased to learn that there is a reasonable number of technical indicators built into the charts. You won’t be able to punch in your own custom indicators or access a list of hundreds of pre-built ones, but it’s still not too bad.

Copytrading

One of the biggest features that eToro makes sure you’re aware of is something called eToro CopyTrader. It’s pretty much exactly what it sounds like.

Prominent, successful traders on the platform can post their portfolios (it’s unclear if this happens automatically or not) for other users to check out, giving them a sense of what kind of investments have been performing the best lately.

Prominent, successful traders on the platform can post their portfolios (it’s unclear if this happens automatically or not) for other users to check out, giving them a sense of what kind of investments have been performing the best lately.

If a user really likes the look of another user’s portfolio, they can choose to copy that user’s trades in real time. The copy trading process is automatic once you’ve signed up to copy another trader’s moves, so interested users can take advantage of the decision-making of other users.

There are a couple of caveats to the CopyTrader program:

- It only applies to cryptocurrency portfolios, not to stocks or ETFs.

- Traders are incentivized to gather copycats and make smart investments via the Popular Investor program.

The CopyTrader program can be a great way for newer investors to watch and learn how their more experienced peers manage their portfolios. Granted, lazier traders can just defer the responsibility of managing their own money to someone else, but smart traders will take it for the learning opportunity that it is.

Popular Investor

Investors on eToro who accumulate enough copiers can apply to the Popular Investor program. The program is set up in four different tiers, from Cadet to Elite, with the financial rewards increasing as a user accumulates assets under copy (AUC) and copiers.

A Cadet level investor can join with as little as $100 and 0 copiers and earn a monthly fee of $2 per copier. An Elite member, on the other hand, will earn 2% of their overall AUC per year, though they also need to have an AUC of at least $500,000 and average equity of $20,000.

Sounds pretty cool, right? Well, there are some major caveats here, as well.

An Elite member may earn 2% of their AUC in fees each year, but they also have to make a one-time payment of $2,500 for the privilege. There are time requirements of 2 months per level, a minimum number of copiers, minimum average equity levels, and other responsibilities.

An Elite member may earn 2% of their AUC in fees each year, but they also have to make a one-time payment of $2,500 for the privilege. There are time requirements of 2 months per level, a minimum number of copiers, minimum average equity levels, and other responsibilities.

It’s a nice program (definitely better than their options rewards program), though one has to imagine the list of Elite investors is very short and will likely stay that way. Still, eToro didn’t need to give their users a way to monetize their portfolios beyond gains and dividends, so they deserve some credit for that at least.

Community

In addition to the portfolio-viewing and copying features, eToro has a whole mini Linkedin-type social network built in. You really just get the ability to make blog posts, read and comment on other people’s blog posts, and add them as friends, but it’s still a nice little feature.

eToro in Practice

Many people prefer to learn by example rather than simply reading a whole article about something. So on that note, let’s see what it looks like when we hop on eToro, check out a cryptocurrency or two, and make a trade.

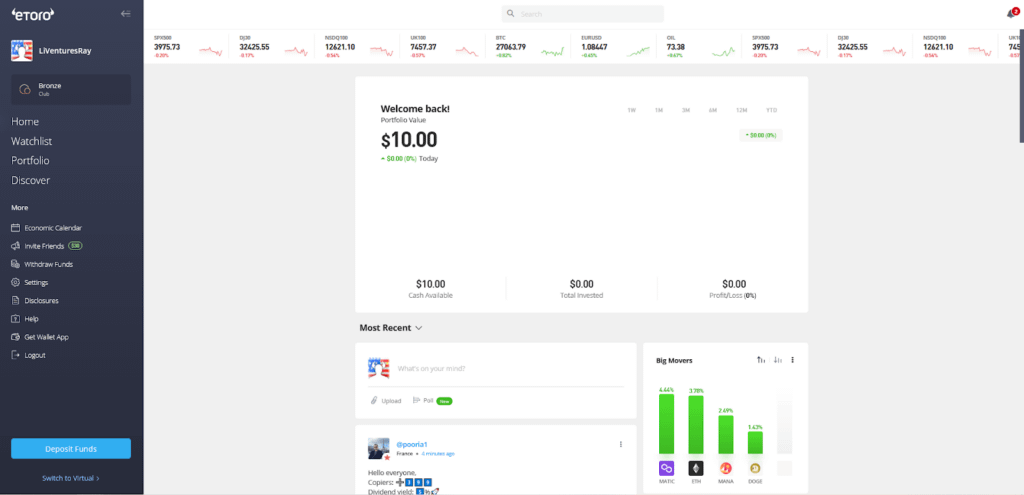

Step 1. Login

When you log into eToro, you’ll be taken to this page:

As you can see, the Home page shows your portfolio’s value and recent performance, as well as some information about market results and today’s biggest movers. This is just a sample portfolio, so there’s not a whole lot going on. That’ll change once you start trading.

You can see a bit of the blog interface at the bottom, and if you scrolled down, you would see some of the most recent posts by eToro users. These range from insightful to insane (just like any other social network), and you can like and comment on them as if you were on a real social network.

Our portfolio’s looking pretty bare, so let’s see if we can find something interesting to spend that $10 on.

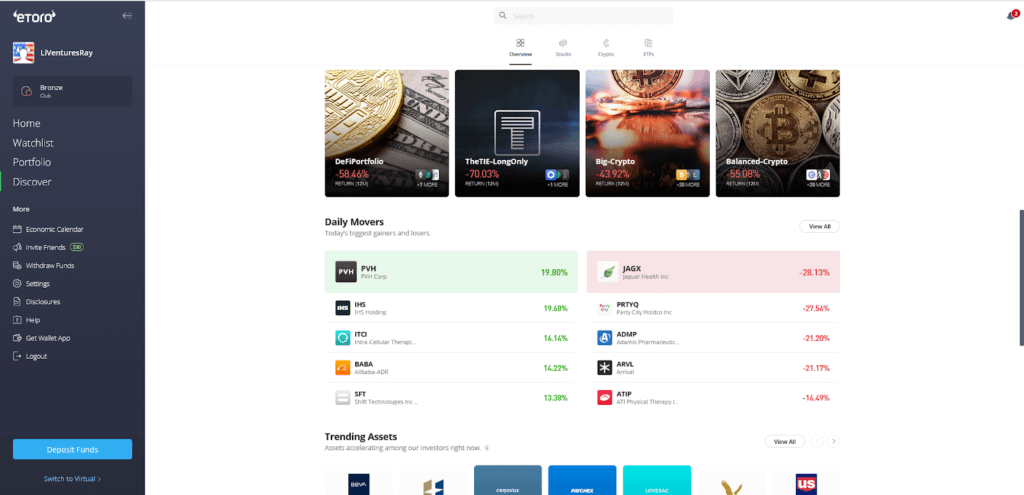

Step 2. Discover

If you click the “Discover” button on the lefthand menu, you’ll be taken to this page:

Here, you’ll get a quick glance at some of the day’s top movers, recommended stocks, and cryptocurrencies, as well as a few different ads for the CopyTrader program.

If you scroll down, you’ll see this:

The panels at the top show some of the recommended Smart Portfolios, which are really just CopyTrader portfolios assembled by eToro instead of by other users. They don’t look like they’re doing so hot, so let’s look at the biggest movers today.

PVH Corp looks like it had a great day. Jaguar Health Inc had an absolutely terrible day. But those are stocks, and we’re looking for crypto. Let’s keep scrolling.

There we go! The Trending Assets panels give us a look at what other eToro users are buying, though these are also stocks. We have some crypto listed in the middle of the page, though it’s hardly a complete list.

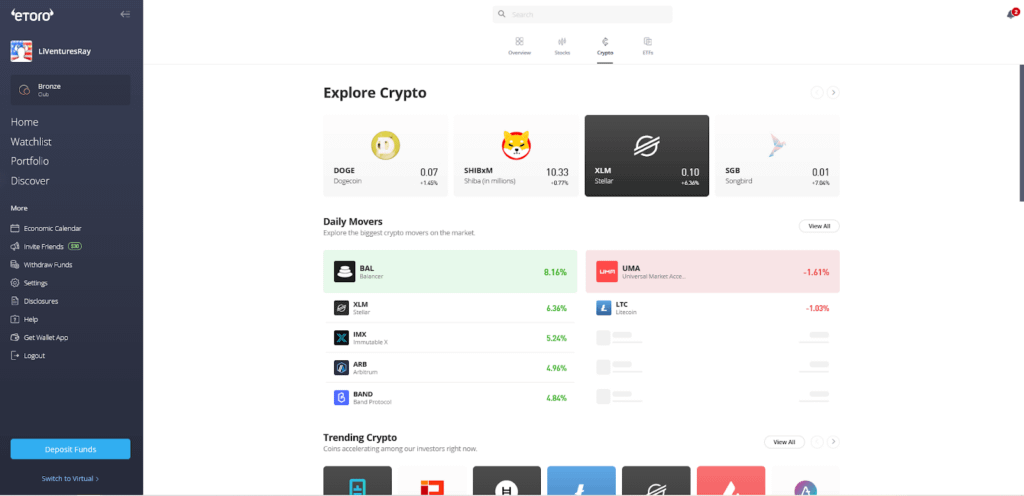

There’s a Crypto button on the top of the page. Let’s see where that takes us.

That’s more like it. Instead of sifting through all the crypto on offer here, though, let’s see what’s going on with Dogecoin. Let’s click the panel and take us to:

Step 3. Check it Out

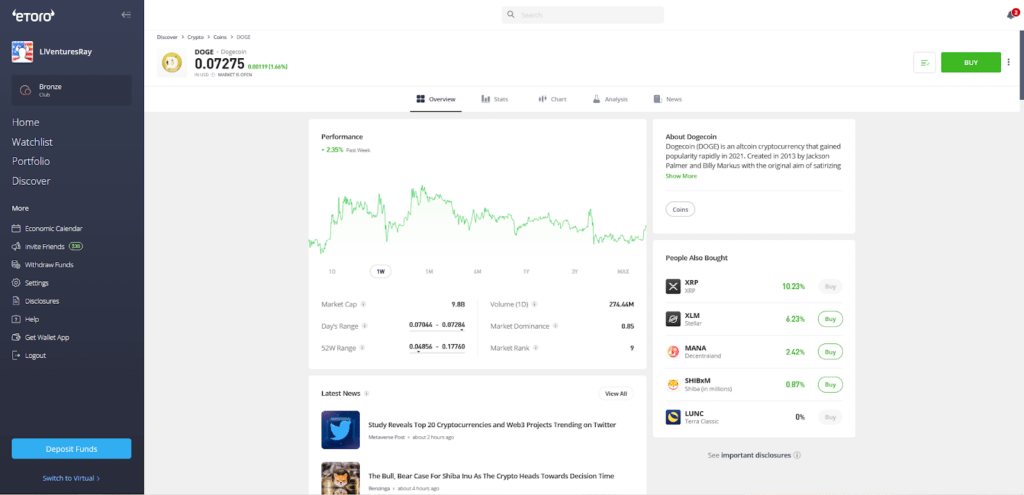

Now we’ve arrived at the Dogecoin overview page. Here, we’ve got a price chart with an adjustable time frame, an expandable “About Dogecoin” information box, as well as a couple of relevant news stories and fundamental data points.

We want some more information before buying anything, so let’s take a look at what eToro has in the way of data, charts, and analysis.

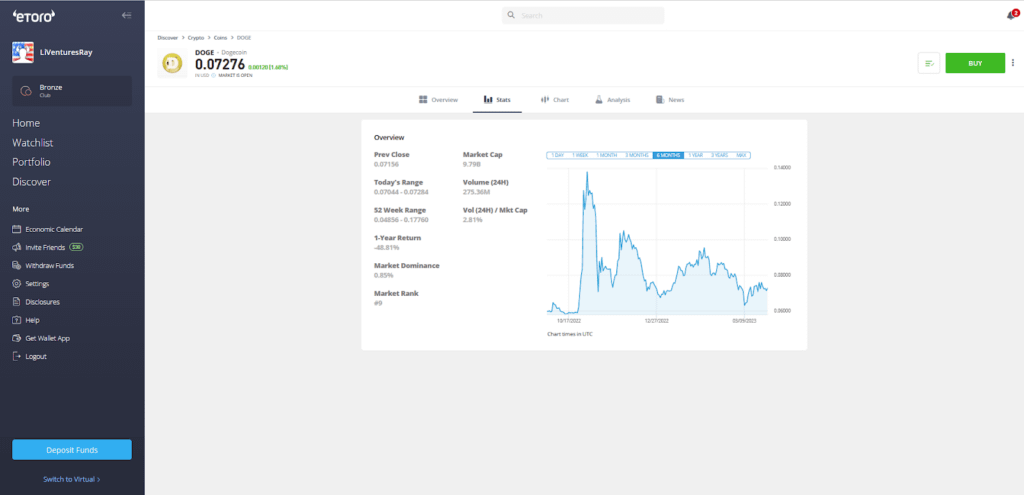

The Stats page is okay, if a little threadbare. It’s got some of the more important aspects of Dogecoin’s history on it, though it’d be nice if we had some more information.

Now, onto the charts. As you can see, eToro’s charts are pretty robust. You’ve got your adjustable time frames, different chart styles, and a whole list of customization and drawing options on the left side. We went ahead and opened the drawing menu as an example. All of the other menus have a similar number of options.

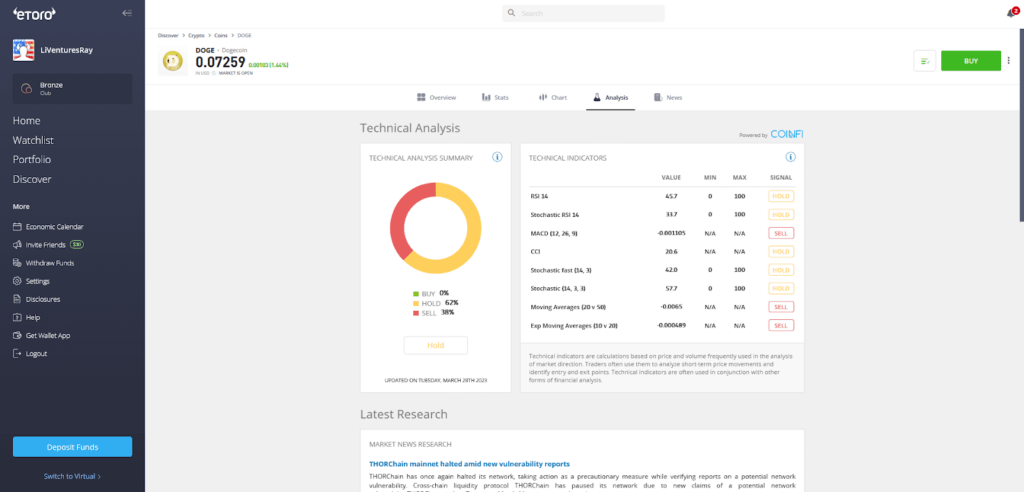

Okay, it’s hard to say if Dogecoin would be a good buy from a quick glance at the chart, so let’s see what the Analysis tab has to offer.

Hmm, looks like the analysts providing information to eToro aren’t too keen on Dogecoin at the moment.

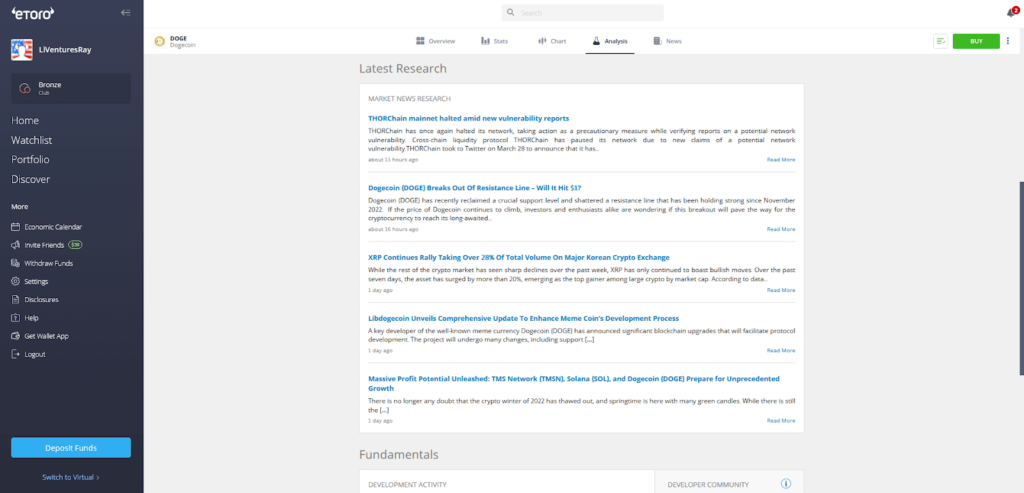

But there is some encouraging research here if you scroll down a bit.

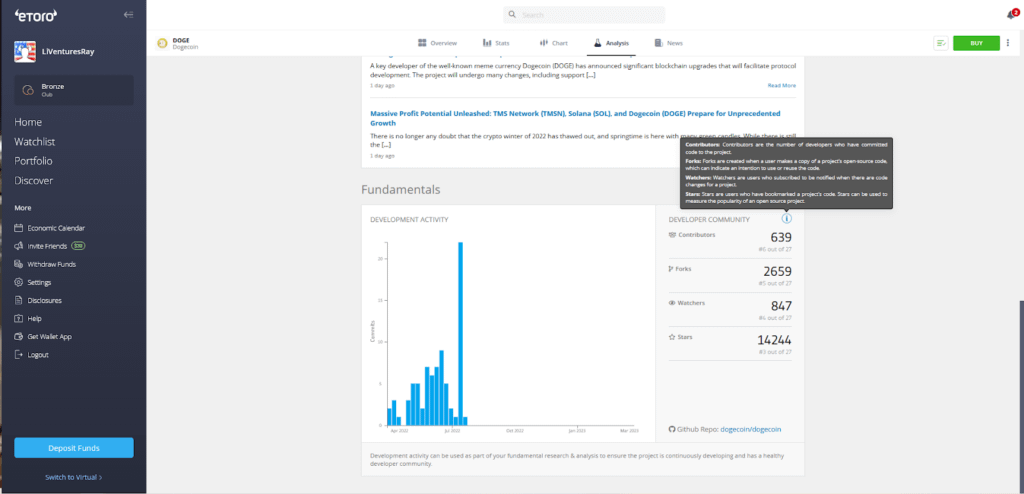

If you scroll down to the bottom, you’ll see this analysis.

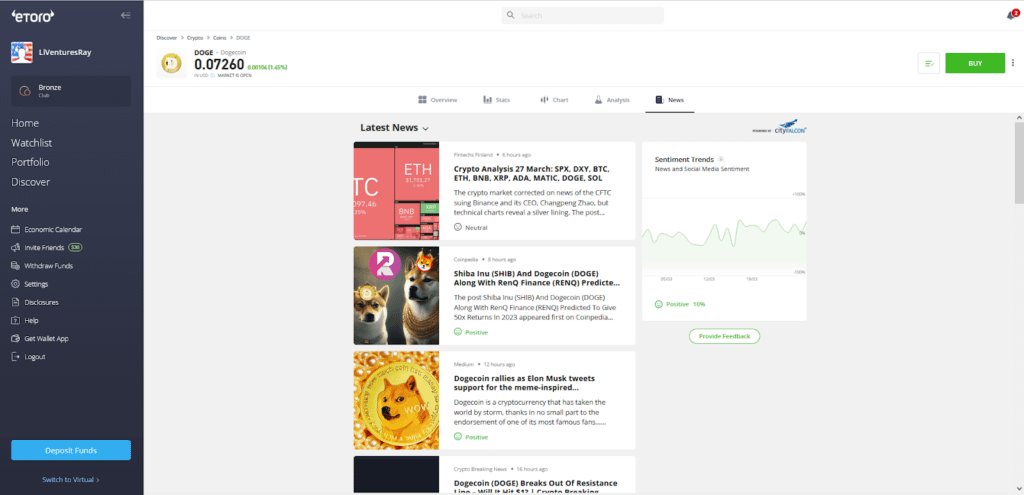

That’s interesting, if a little above our pay grade. Now let’s see what the News tab has to say.

Some encouraging news, some positive social media sentiment…you know what? Let’s buy some. You only live once, right?

Step 4. Buy It

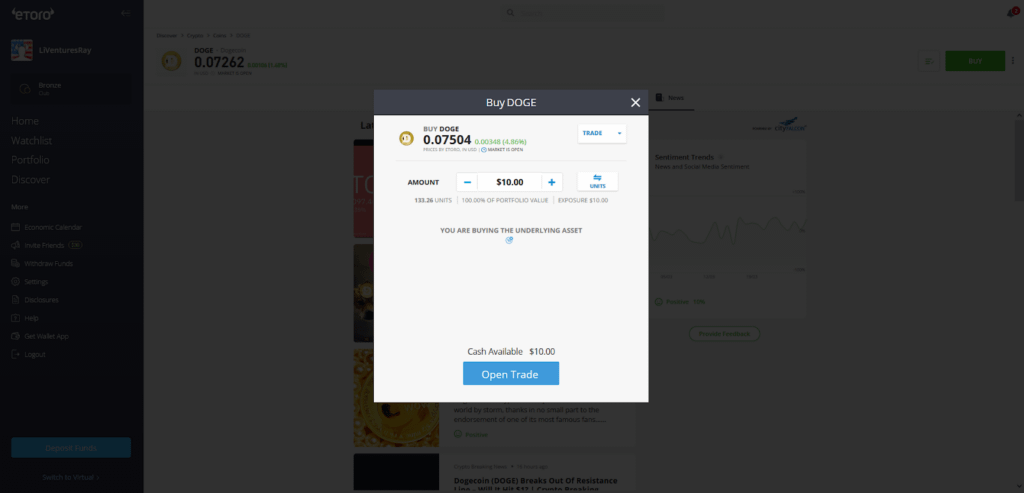

Let’s click the Buy button.

And…

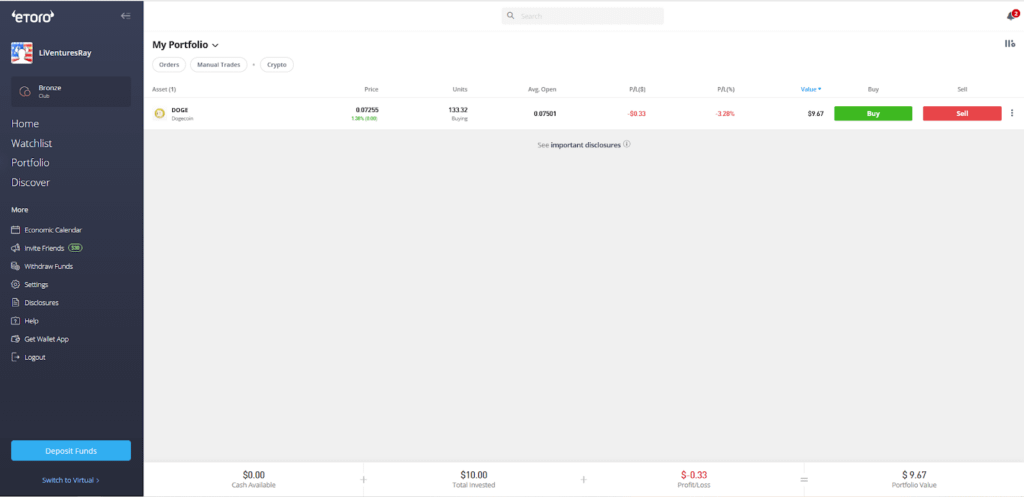

Boom! We’re the proud owners of $10 worth of Dogecoin. Here it is in our portfolio:

It’s not much, but it’s a start.

So there you have it. There’s more to eToro, of course, but now you have a sense of what it’s like to use it on a basic level.

Conclusion

eToro is a cryptocurrency-focused platform with some interesting community features built in. It won’t win any awards for its fees or for its stock/ETF trading, but that’s okay. Not many platforms will let you copy another person’s trades in real time, after all, and there certainly aren’t many that will pay you for every person who copies your strategy.

Our Methodology

We rated eToro based on a few different metrics:

- Tradable Assets

- Usability

- Research and Analysis

- Fees

- Unique Selling Points

Tradable Assets

This just reflects the types of assets you can trade on the platform. Some platforms are focused on one or two, while others offer a much larger selection.

eToro technically supports stocks, options, and ETFs, but it’s really a crypto broker at heart. We can’t really give it full marks for this category. It doesn’t have many stocks or ETFs available for trade, and even its crypto selection is rather small.

Usability

This one reflects the answer to the question: How easy is eToro to use?

The platform is simple, easy to navigate, and not too cluttered with information. It’s clearly designed to be used on mobile, not desktop, which is kind of good and bad in its own way.

We gave eToro good marks for usability because of its intuitive interface and layout, though the lack of a proper desktop option keeps it from getting the best score.

Research and Analysis

There’s no way around it: eToro just doesn’t have the same kind of research and analysis features as some of its competitors. It seems content to give you the most basic content it can get away with, and its conspicuous lack of analytical tools really hurts it in this category.

All that said, eToro does have some pretty nifty charting features, and that’s worth something at least.

Fees

This one’s simple. Does eToro charge more, less, or as much as its competitors?

When it comes to stocks, options, and ETFs, eToro is right in line with the fee-free models that other platforms use.

When it comes to crypto, on the other hand, eToro charges more in fees than most of the other crypto-trading platforms out there. And since that’s eToro’s main business, those fees hurt it in this category.

Unique Features

eToro wins big in this category. Its CopyTrader and Popular Investors programs are unique and interesting, especially when you consider the monetization opportunities.

The social media functions aren’t unique to eToro, but they’re done well enough that they’ve earned the platform some kudos in this category.

The post eToro Review 2023: How Good Is eToro, Really? appeared first on FinMasters.

FinMasters