Table of contents:

Quick Stock Overview

Pepco by the numbers.

1. Executive Summary

A brief discussion of Pepco and its potential appeal to value investors.

2. Extended Summary

A more detailed explanation of Pepco’s business and competitive position.

3. Recession and Discounters

The coming European recession and the rise of discounters.

4. Pepco’s future

Aggressive growth and expansion in new markets

5. Financial results

Reasonable valuation and impressive per shop profitability

6. Conclusion

Why Pepco is worth a closer look.

Quick Stock Overview

Ticker: PCO.WA

Source: Yahoo Finance

Key Data

| Industry | Retail / Discount |

| Market Capitalization ($M) | 4,050 |

| Price to sales | 0.9 |

| Price to Free Cash Flow | 19 |

| Dividend yield | – |

| Sales ($M) | 4,495 |

| Free cash flow/share | $2.39 |

| P/E | 26 |

1. Executive Summary

Europe is under immense pressure from the consequences of the Ukraine war. Progressively cut off from Russian energy, the continent’s economy is not unlike a cruise ship heading for an iceberg. Massive damage is inevitable, and investors are heading for the lifeboats.

This crisis will place serious economic stress on European consumers. That’s a burden, but it will be a tremendous opportunity for shops able to provide quality products at affordable prices. As budgets tighten and discretionary income shrinks, brands owned by the Pepco Group, which has long emphasized affordability, will fill the gap left behind as more expensive brands and outlets see sales shrink.

The company has fine-tuned its business model in Eastern Europe for 2 decades, offering quality goods at very low price points while still generating a gross margin double that of traditional clothing retailers. In parallel, its successful UK-based brand has shown it how to create a more diverse discount offer successfully in more affluent countries and urban areas.

The two brands are now expanding into the Western European market, which has a large middle class fearful of downgrading its lifestyle in difficult times. Pepco allows struggling families to maintain their shopping habits, even on a budget.

The company is fairly valued for a retail stock and undervalued for an exponential growth stock.

The main limitation of Pepco is not the business fundamentals but its listing on the Polish Warsaw stock exchange, which gives it limited visibility. US investors will need to have a brokerage account with a broker giving access to this stock exchange to buy the shares.

2. Extended Summary: Why Pepco?

Recession & Discounters

Europe is heading into a recession, driven primarily by the soaring cost of energy. This will benefit discount retailers who provide necessary items at low prices. Pepco is a discounter with strong pricing advantages thanks to a strong focus on its supply chain and cost structure. It also manages a portfolio of different brands, enabling the Company to capture a market beyond its core retail apparel niche.

Pepco’s Future

Pepco management is unfolding a long-in-the-making plan for expansion in the richer Western market, beginning in Germany, Austria, and Italy. The first results are promising and expansion is accelerating.

Financials

Pepco results are solid, the balance sheet is safe and growth is accelerating. Shop profitability is very strong and the new shops in Western countries are highly profitable.

We’ll also discuss Pepco’s ownership structure and how to invest.

This report first appeared on Stock Spotlight, our value investing newsletter. Subscribe now to get research, insight, and valuation of some of the most interesting and least-known companies on the market.

Subscribe today to join over 9,000 like-minded investors!

3. Recession & Discounters

The Coming European Recession

If you follow financial news, you have seen a lot of discussion about energy prices, recession, and the impact of the Ukraine war. To sum it up, the whole world is short of energy, and the shortage is especially acute in Europe. The continent suffers from shortages for several reasons:

- Excessive dependence on Russian gas.

- Insufficient renewable production to replace closing fossil fuels plants.

- Aggressive closure of nuclear power plants (especially in Germany).

- Dramatic reduction in Russian gas inflows to punish European countries supporting Ukraine.

- A lack of LNG ports able to receive gas from other sources.

- A planned embargo on Russian oil by the end of the year.

- A strong drought has reduced hydropower generation in most of Europe, and also reduced nuclear output.

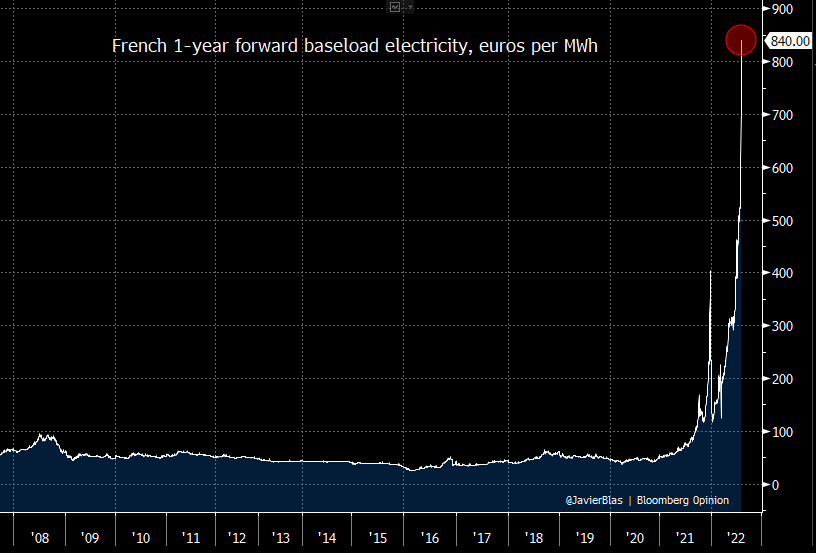

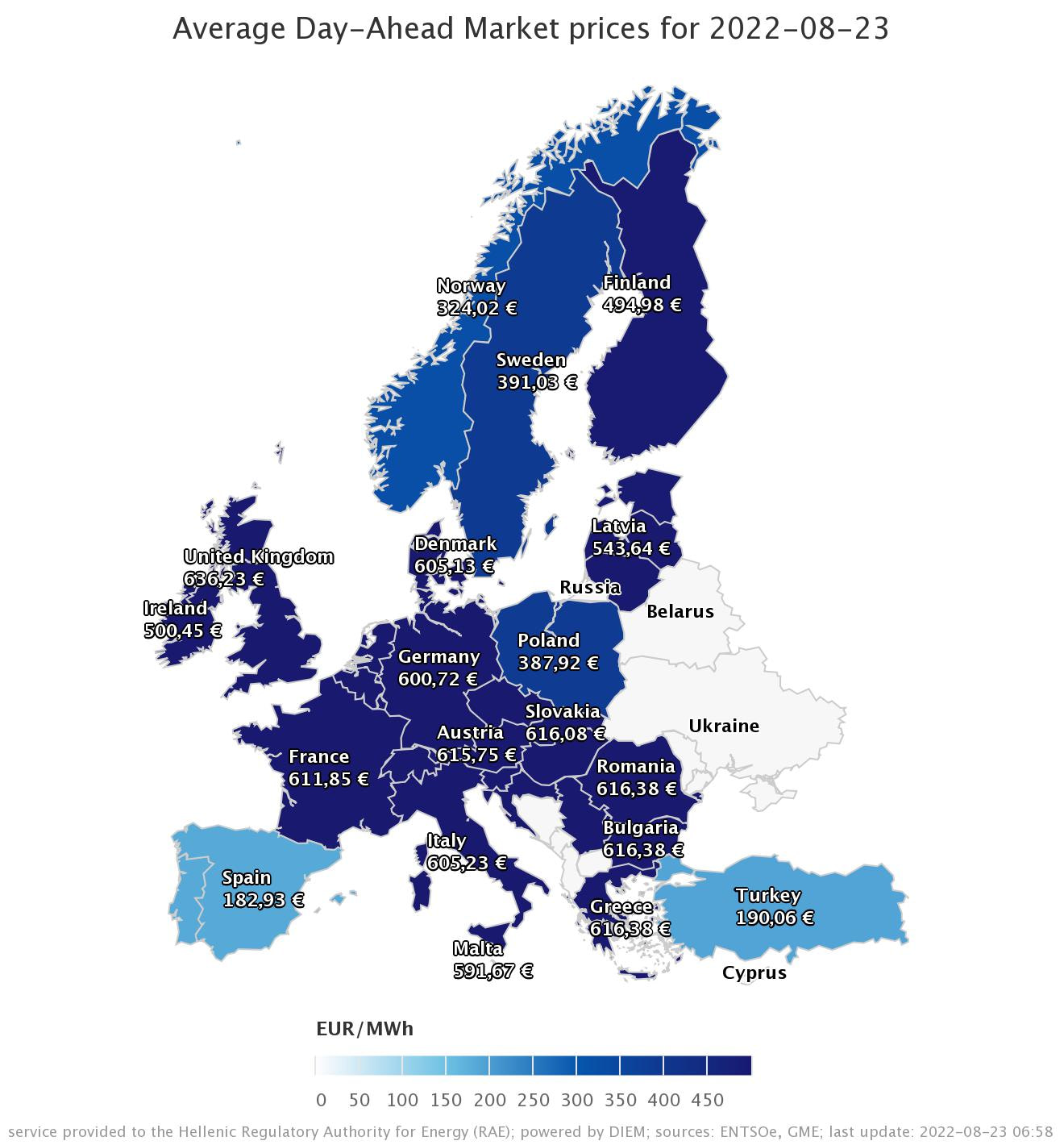

All of these factors have resulted in skyrocketing electricity and energy prices. For just one example among many, we can look at the price of electricity in France: it went from below 100 €/MWh (even in the “high energy era” of 2008) to 840 €/MWh. For reference, 600 €/MWh is the equivalent in energy of $1000/barrel of oil. Essentially, electricity is becoming too expensive for many Europeans to use.

The consequence of this brutal rise in energy costs will be felt by both companies and consumers. This comes on top of pre-existing inflation at higher levels than Europe has seen for decades.

Energy price increases could double UK inflation up to 18% and energy bills are expected to soar from £2,000 to £4,000 or more. Germany, the industrial center of Europe, is rapidly closing down metal smelters and fears factories leaving the country in droves. And if that was not enough, the drought has done extensive damage to agricultural yield, so food prices are up as well.

Energy use is largely inelastic: even the highest prices can only cut demand to a certain level. People can cut consumption to some extent, but when they’ve cut all they can, they will cut from other spending in order to afford the energy they need.

Closing factories, impoverished consumers, and a recession right ahead paint a grim picture for European equities, especially the ones focused on retail, right?

The Opportunity in the Crisis

Every crisis creates an opportunity. The current European energy crisis promises to be painful, but it will not be world-ending either. Instead of panicking, we should focus on the consequences and who will profit from them.

When pressured by rising prices and large energy bills, European consumers will not suddenly stop buying things altogether. We live in a consumer society and people will not stop shopping. However, they will look for better prices. The primary beneficiaries will be discount brands and outlets.

The problem is that most of the major discounter franchises (like Aldi and Lidl) are private companies and not publicly listed. Investors cannot buy their shares. This also means that the very few discounters that are publicly listed should at some point get attention from the investing community.

The ideal target will be a company small enough to have room to grow, but also big enough to have already reached an economy of scale. It should operate in multiple countries. Since we’re focused on Europe, the stock covered in this report, the Pepco Group, fits the bill.

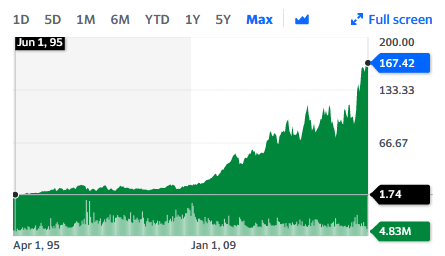

Can such an investment be profitable? Judging by the American equivalent of the “dollar store” concept, it can be a good bet. For example, the Dollar Tree franchise stock has gone up almost x100 since its listing in 1995.

The Pepco Brand

Pepco is a Polish retailer focused on apparel, housewares, and toys. The focus of the brand is on “Mums on a budget“. This is a solid target in the current context. No matter how tight the budget gets, kids will need bigger clothes and need birthday presents. As a father of a 4-year-old boy who is growing like a weed, I can confidently say that this is not an expense you can avoid.

Pepco offers a selection of clothing with a store space roughly arranged with 50% kids’ apparel, 35% women’s clothing, and 15% men’s clothing. Apparel accounts for most of the shop space, with around 20% for toys, household items, and kitchenware.

The thought process is rather simple: “Mom goes to the shop to buy new clothes for her kids, enjoys browsing very affordable clothes for herself, and might even bring back something for Dad“. Some extra cheap toys, glasses, pillows, candles, or batteries are tempting as well and can increase the total visit value.

If some clothes don’t fit and need to be returned, you can return them to any shop in the franchise for 30 days.

As a side note, I must say I live near several Pepco shops and this shopping process is something of a ritual in our family several times a month. This is actually how Pepco first came to my attention. Both clothes and toys are cheaper than anything I could buy direct from China on AliExpress.com.

” Visiting stores and testing products is one of the critical elements of the analyst’s job.“

Peter Lynch

Peter Lynch is THE reference on investing out of the beaten path. So beyond my direct experience, I went around and grabbed some of their marketing material to show their price range. Frankly, these prices are unbeatable in my area.

Pepco’s marketing approach focuses on low prices for goods that don’t feel cheap. That’s important for apparel, which is so tied to self-image and social status. If you don’t mention it, no one will notice that you dressed yourself or your kids for a quarter of the price you’d have paid in a mainstream store.

You can judge by yourself (and forgive my poor photography skills):

Click on images to enlarge

Price can be one of the strongest moats possible. It is also a very durable sales point. This is something another extremely successful brand, Amazon, knows very well:

The obvious answer is that customers will always want low prices, fast shipping and a large selection. It’s impossible to imagine someone saying, “‘Jeff, I love Amazon, I just wish you delivered a little more slowly. When you identify those big ideas that are stable in time… they’re usually customer needs.

I think Pepco is in a similar position. None of its customers will tell them, “I wish it was a bit more expensive, a little less good quality or that you did not have the cheapest possible children’s clothes and toys“.

The Pepco Business Model

Pepco products are not just remarkable for their prices. The quality is not much different from more expensive competitors like H&M or Primark. There are even plenty of popular branded kids items like Jurassic World, Harry Potter, Star Wars, etc, usually below 5 €. Non-branded apparel can be as low as 2-3€. Multiple socks or underwear might be 1€ or below.

So how does Pepco do it? Through a remarkable mastery of their supply chain and rigorous cost control.

The Pepco Supply Chain

Most apparel retailers buy their products through intermediaries. This allows them to pick from an absolutely gigantic pool of suppliers worldwide. This way they can frequently turn over their collections, bring in new designs, and keep their offers fresh and trendy.

This flexibility and constantly changing selection come at a cost. Intermediaries need to make a living as well. So the average gross margin with this third-party supplier model is usually around 25%.

By comparison, Pepco claims a 50% gross margin.

Pepco achieves this through direct relationships with the factories producing the clothes and goods. Most of the goods come from China, but new suppliers are entering the company’s supply chain, notably in Turkey, India, Bangladesh, and Pakistan.

PGS, Pepco’s sourcing department has also directly performed 2,000 factory audits since 2017 to keep a close eye on product quality.

Cost Control

The other side of the price story is cost control. Pepco shops are generally smaller than other apparel retailers, so the selection is smaller. But really, how many 5-year-old-size T-shirts with Star Wars or Harry Potter branding do you need to see before choosing one for your kid, especially at a 3-5€ price tag?

Smaller shops allow for fewer employees and lower rent payments.

A smaller selection also allows for faster inventory turnover, and the ability to replace a bigger segment of the inventory at limited costs. While larger brands like H&M or Primark need third-party suppliers to source enough products to stock a large store, Pepco can do it directly.

Lastly, Pepco management is razor-focused on cost optimization. It is significant to see large sections of corporate communication to investors focused on “small” things like switching all lights to LEDs or stopping all air freight to cut costs.

The company is also adopting self-checkout in the newer shops and implementing modern ERP (Enterprise Ressource Planning) software in its warehouses, so we can expect the overall efficiency to keep going up.

4. Pepco’s Future

I previously said that I wanted the discounter in this report to have space for aggressive growth. At the moment, the Pepco group is mostly an Eastern European and UK brand, and even the UK presence is far from reaching saturation, with fewer shops than Poland despite a 50% larger population.

The Company has just initiated expansion into the continental Western European countries. This means it has an untapped market of 200-300 million people right next door.

This is a region where most customers used to look down on discounters. With a brutal recession and economic crisis brewing, the financially stressed middle class is likely to give a boost to the sector.

The Brands

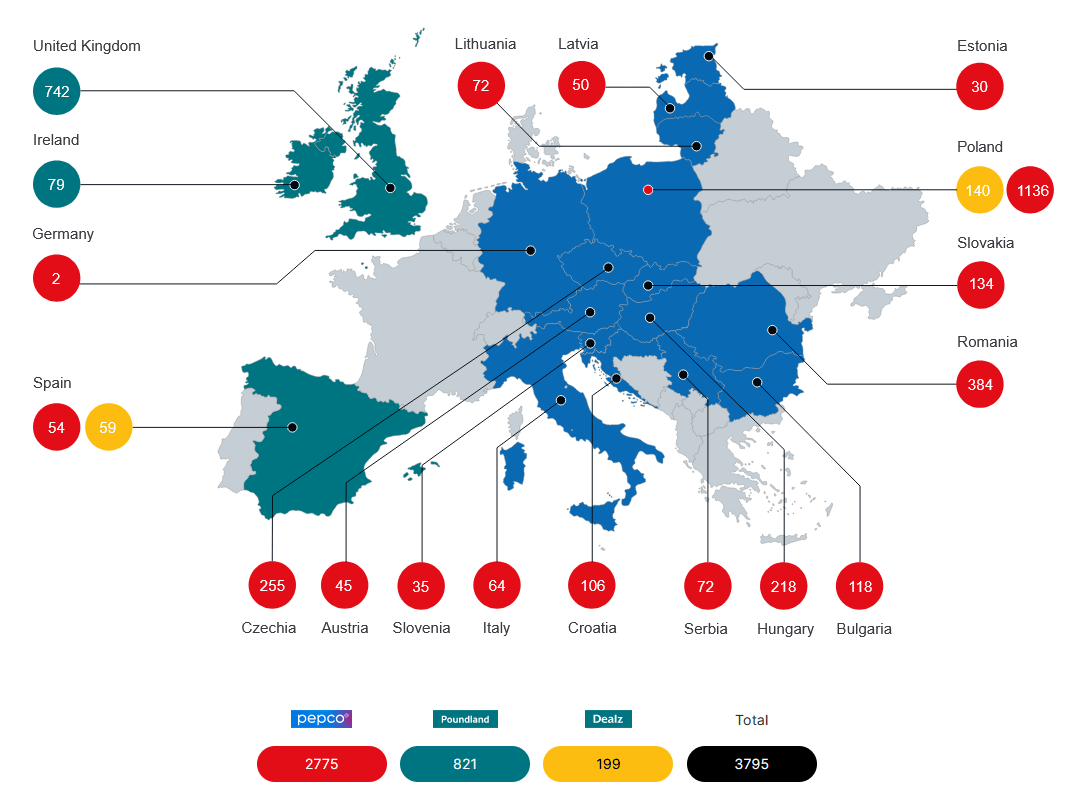

For the sake of simplicity, I have so far described Pepco as just one type of shop. This is partially true, as most of the group shops are like the one I have described so far. The Polish-born Pepco shops (in red below) represent 2/3 of the total shop count and most of the new openings.

The Pepco Group has two more brands: Poundland and Dealz.

You can see how Pepco describes each brand below.

Apparel for the whole family, home decor, toys and seasonal products, serving over 20 million customers a month.

Amazing value across top brands and private label products, serving more than 7 million customers a week.

Unbeatable value for FMCG, GM and apparel across locally and internationally sourced products.

PGS sources directly through its operations, including in China, Hong Kong, Bangladesh, Pakistan and India.

Poundland

Poundland shops have roughly twice the area of typical Pepco shops. They basically integrate a slightly smaller Pepco shop (the clothing + house items section) and combine it with other product lines, typically:

- frozen food

- cosmetics & haircare

- cleaning products

- small electronics (cables, headphones, etc…)

- pet products

- snack/soft drinks/tea.

Initially, a stand-alone UK brand acquired by Pepco, Poundland is by now more of a “Pepco + other products” concept. The idea behind Poundland is to serve a relatively more affluent customer than the typical eastern European customer, who is willing to spend on pet products, cosmetics, etc.

In terms of pricing, the strategy is the same: great value + rigorous cost control. By increasing the product selection with consumables at a cheap price, Poundland increases the average cart value and encourages even more regular visits.

You might go back for dog treats, frozen veggies, or an iPhone cable and end up leaving with some toys, clothes, or shampoo as well.

Poundland is located in more urban areas, while Pepco can be in any smaller local shopping center, part of the 2-5 shops attached to a supermarket.

Dealz

Dealz is basically the outside-the-UK Poundland. The concept is similar but adapted to local consumer behaviors and habits. Customers can find locally-sourced brands and products they already know, instead of just foreign-sourced items. This means that each country will have a similar, but not identical Dealz product selection.

Dealz was tested in Ireland before being successfully expanded in Spain and Poland. The concept was successful, and like Poundland, fit more dense and urbanized areas.

Aggressive Growth

Past Growth

The Pepco Group store count has increased exponentially in the last 2 decades.

Pepco began in 2003 with 14 stores. In 2007, the 100th store opened; in 2016, the first 1,000th; in 2020 the 2,000th. There are now close to 2,800 Pepco shops.

The same is true for Dealz, which opened in Ireland in 2011 and saw its 100th store open in 2020. Poundland has reached 800+ stores since its 2016 acquisition.

Future Growth

The 2022 store count is up 10% over 2021. In total, the Group plans to accelerate even more and open 450 new shops this year.

This is all before expanding to the richer and more populated Western countries of Italy, France Germany, the Benelux, the Netherland, and Germany. With Europe, in general, getting poorer for a while, it is likely that the experience acquired in Eastern Europe will be valuable as Pepco moves into these markets.

Pepco expects to open another 1,000 shops in Eastern Europe, possibly more, before reaching saturation.

In Western Europe, another 2,200 shops could be opened in the markets Pepco has already entered (Italy, Germany, Spain, Austria). There is also a significant untapped market in France, Belgium, The Netherlands, and Greece. Beyond that is Scandinavia, a rich but sparsely populated market.

In total, I would expect 4,000-5000 new shops to be possible, or almost tripling the current number, a target that would likely take 7-10 years to reach.

Considering that these markets are expected to be more competitive, Pepco was probably wise to focus its resources on expanding and reaching the critical mass of 3000+ shops. This is the scale needed to spread the costs of corporate overhead, ERP software, warehousing, and supply chain management and achieve the economies of scale needed to keep prices down.

We can extrapolate from the Italian market. Pepco has doubled its presence from 25 to 49 stores. Each store has the same level of activity as in other countries (around 3,000 transactions per week) but the average basket is 85% bigger than in Eastern Europe. The same seems to be true for the stores opened in Spain, Austria, and Germany.

Pandemic & War

COVID-19

COVID-19 was a serious problem for the Pepco Group over the last 2 years. Some of the Christmas 2021 inventory was delivered late and will be sold in winter 2022. Depending on the country, many shops were closed or only accepted vaccinated customers.

Because of this, 2020 was Pepco’s first year on record with stagnant revenue (but still growing EBITDA). This still did not stop Pepco from registering a profit, a remarkable achievement for a physical retailer in a locked-down economy. The pandemic was a rigorous test of Pepco’s resilience, and the Company seems to have passed the test.

War

The war in Ukraine has had a limited impact on Pepco. If anything, it might even boost its activity, with 1-2 million Ukrainian refugees in Poland alone, mostly women and children. Once they manage to settle themselves in a safe zone, they will appreciate a provider of cheap, high-quality clothing and other necessities.

With Pepco supply chains drawing products mainly from East Asia, geopolitical risk is limited for now. An expansion of the war in Ukraine or a crisis in Taiwan could change the situation.

In fact, the only impact for Pepco I could find of the Ukraine war was a decline in the stock price in the last few months. All Polish stocks have suffered in a general market decline, making a cheap stock even cheaper. We can expect the Eastern European markets to keep fluctuating in the next months depending on how the war in Ukraine evolves. This could discount the stock even further.

5. Financial Results

Growth, more Growth, and Inflation

Pepco’s focus is rapid expansion, and its financial metrics reflect that. Revenues are up 19% for the first half of 2022, and so are operating costs. With H1 revenues at €2.4B already, 2022 seems set for new record-breaking revenues.

| FY19 | FY20 | FY21 | YOY Change | |

|---|---|---|---|---|

| Stores | 2,694 | 3,021 | 3,504 | 14.8% |

| Revenue (€m) | 3,415 | 3,518 | 4,122 | 15.8% |

| Underlying EBITDA (€m) | 333 | 442 | 647 | 37.6% |

| Underlying PBT (€m) | 202 | 49 | 244 | 133.1% |

| Net Debt (€m) | 461 | 1,239 | 1,202 | -3% |

| Cash Generated from Operations (€m) | 236 | 628 | 752 | 18% |

Source: PEPCO

Overall, the company has managed to keep its margins mostly intact, even if inflation put them under pressure. Some costs are up, like freight and energy, but they are offset by higher efficiency in general operations and supply.

This has allowed Pepco to keep prices mostly unchanged. This should reinforce its brand and position with customers beset with rising prices. Price leadership will also be highly beneficial to its entry strategy into the western European markets.

Since 2019, net debt has risen rapidly, in parallel to store growth. It is not putting the company at risk, but access to capital is still a constraint on the growth rate. I would still expect that ability to “digest” growth is also a constraint, so growth could probably not accelerate much more even if the Company takes in more debt.

Store Performances

The new shops in Western Europe are more expensive to set up, with almost double the CAPEX requirement per store. Earnings per shop are also 15% higher.

This brings the payback period for each shop to 25 months, compared to the very short 18-month payback period of the Eastern European shops.

Any money manager or entrepreneur would be jealous of that rate of return. As long as there is more space in Europe for new shops, Pepco is likely to stay a quickly growing compounding machine.

| Typical Store Annual Performance | PEPCO CEE | PEPCO WE |

|---|---|---|

| PROFIT & LOSS | ||

| Revenue (€m) | 1,000 | 1,600 |

| Underlying EBITDA (€m) | 225 | 260 |

| INVESTMENTS | ||

| CAPEX | 175 | 325 |

| Pre Opening Costs | 35 | 50 |

| Working Capital (€m) | 70 | 75 |

| Return Metrics | ||

| Payback Months (post tax) | 18 | 25 |

| IRR | 72.7% | 61.2% |

Source: Pepco Presentation

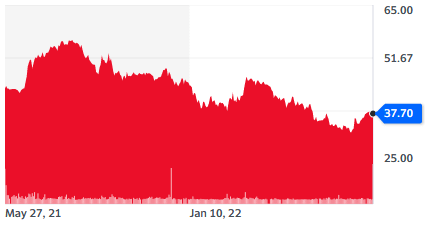

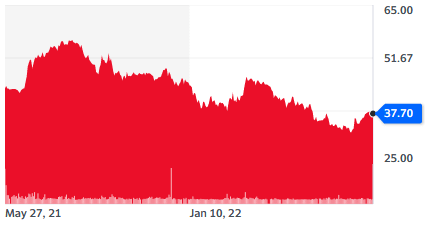

Stock price

Since its 2021 IPO, Pepco’s stock performance has been far from stellar. The price chart below is even worse if you would convert it into dollars, as the Polish zloty, along with all European currencies, has crashed brutally against the dollar in the last few months.

This is despite the company managing to achieve all its objectives and more. This has happened for several reasons.

- Brick-and-mortar retailers were out of favor during the pandemic.

- A listing on the Warsaw stock exchange makes Pepco stock virtually invisible for most investors in Western Europe and the USA.

- The war in Ukraine has scared investors out of all “Eastern Europe” stocks.

- While the USA might be in a recession, Europe might be headed for an energy crisis-induced depression.

- The crashing currency has removed any foreign interest in Polish stocks.

Interestingly, almost none of those reasons should really affect Pepco. The Company did well enough during the pandemic, the war did not affect it, and it should benefit from mothers hunting for bargains after struggling to pay their energy bills.

But with only 8 analysts covering the stock, it is not so surprising to see Pepco trading as “some Polish retail stock” rather than “an aggressively growing profitable European company”. In that respect, increasing its footprint on the ground in Western Europe will most likely put it on the radar of more investors and analysts at the same time it gains new Western customers.

This seems to me to be a stock for patient investors, ready to wait for the compounding effect to kick in over a period of 5 or more years.

From a purely trading point of view, the current negativity and Europe’s woes are probably not yet at their peak (this could be happening during the very energy-poor winter ahead, with “surprising” higher inflation), so we might see some time before a bottom. Alternatively, a “discounters are a refuge” narrative could appear rapidly.

Valuation

By most metrics, Pepco seems rather cheap. Its P/E ratio is 24, pretty low for a company growing 10-20% a year. We need also to remember that earnings are pushed lower by all the massive investment in new shops that will pay for themselves in 2 years.

Free cash flow has been positive since 2019 and growing rapidly. At the current level of the Trailing Twelve Months (TTM), the price to free cash flow is 19.

In addition, most of the quickly growing CAPEX and investing cash flow spending is to fund accelerating growth (new shops), and not maintenance CAPEX. So the free cash flow would probably be even higher if Pepco was not investing massively in growth.

Using 2021 free cash flow numbers, the price to free cash flow ratio would be 8.7.

PEPCO Cash Flow

| Breakdown | TTM | 9/29/2021 | 9/29/2020 | 9/29/2019 | 9/29/2018 |

|---|---|---|---|---|---|

| Operating Cash Flow | 464,154 | 702,416 | 579,571 | 182,127 | 76,162 |

| Investing Cash Flow | -219,223 | -183,613 | -165,358 | -130,870 | -177,190 |

| Financing Cash Flow | -444,109 | -414,995 | -243,194 | 12,868 | 173,168 |

| End Cash Position | 282,828 | 507,702 | 400,167 | 246,974 | 184,485 |

| Capital Expenditure | -224,310 | -180,893 | -163,944 | -135,811 | -112,627 |

| Insurance of Capital Stock | 58 | 58 | – | – | – |

| Insurance of Debt | 626,897 | 606,897 | 53,000 | 457,116 | 282,369 |

| Repayment of Debt | -753,659 | -735,439 | -53,000 | -302,534 | -825 |

| Free Cash Flow | 239,844 | 521,523 | 415,627 | 46,316 | -36,465 |

Source: Yahoo Finance

How To Invest in Pepco

The Pepco Group is listed on the Warsaw stock exchange in Poland. It should NOT be mistaken for Pepco Holding, a US electric utility.

It is possible to buy Warsaw-listed stock of the Pepco Group (PCO.WA) through a broker offering access to European stock exchanges, for example, Interactive Brokers. For a full explanation of how to invest directly in foreign stocks, you can read our recent article on the topic.

Another option can be the German stock exchange Börse München (based in Munich). Pepco stock is listed on it in euros, in something that seems similar to a GDR. Unfortunately, the page and interface seem exclusively in German, so direct purchase might prove more than a bit tricky. An international broker giving access to the Warsaw stock exchange will be a better option for most investors.

Pepco Shareholders

Before being listed separately, Pepco was owned by Steinhoff International Holding. The company owns several retailers, including declining brands like France’s Conforama. Steinhoff is massively indebted and in the process of renegotiating its debts.

Pepco was spun off in an IPO, essentially to provide fresh cash to Steinhoff to help them manage their debt load. Steinhoff still owns 79% of the Pepco Group. In the long run, I expect Steinhoff to progressively sell its other holdings to pay off debt.

On one hand, this might put pressure on Pepco’s share prices. On the other hand, this will not affect fundamentals like the explosive growth of Pepco, nor its entry into lucrative Western European markets.

I am not really impressed by the quality of management and of investing decisions at Steinhoff Holdings (short of Pepco). Luckily, they seem to have a rather hands-off approach to the handling of their brands, letting each brand’s managers work without interference.

Overall, the Steinhoff ownership is a negative in my view. Especially as they hold a controlling interest, placing minority shareholders’ rights a risk.

Still, the quick growth of Pepco, supporting a rise in share price, is in Steinhoff’s interest. So I would consider their interests mostly aligned with minority shareholders.

The largest risk would be Steinhoff being forced to sell its Pepco holdings too soon, and the buyer then taking the company private. This is a low risk, but it exists. Considering how many extremely successful other discounters like Lidl are kept private, this could well happen.

6. Conclusion

Pepco Group is a high-growth stock at a reasonable price. Its current valuation is not dirt cheap, but not excessive either. What markets are likely mispricing is the size of the growth runway the company has.

Pepco perfected its business model and optimized its supply chain in the tougher and poorer Eastern European markets. It also acquired plenty of experience in operating discount shops in richer markets through the UK-based Poundland brand.

The combination of experience-tested shop design and optimized supply chain is Pepco’s secret weapon. This gives Pepco the perfect mix to take the Italian, Austrian, German, and other markets by storm.

Shops in these locations are more expensive to set up. Early results also indicate they are likely to be more profitable on a per-shop basis. These markets can harbor 1x-2x the existing shop number. This would give Pepco the potential to multiply its revenues and profits by 2 to 4, all things being equal.

The next years will be challenging for European companies and consumers. This should initially boost the results of discounters like Pepco, allowing them to cut into the market shares of more expensive retailers. In that respect, the long-planned expansion of Pepco to the West could not have come at a better time.

Still, it is possible that Europe enters into an extended recession or even a depression. This is a possibility that should not be discounted, especially with the conflict in Ukraine showing no sign of ending any time soon.

Pepco is ideally structured to survive a crisis of this scale, more than most of the continent retailers. It might nevertheless suffer on the way. It is also possible that the shares’ price could crash with the rest of European equities, no matter the company’s fundamentals.

Such a crisis should also deeply affect Steinhoff’s other holdings, making a forced sale of Pepco more likely. So in addition to Pepco’s success in its westward expansion, I would recommend keeping a close eye on Steinhoff’s debt restructuring progress.

To sum up, I am quite confident in the long future of Pepco but can see some risks in the short term that should be taken into account. There is also a good chance of high volatility in the year ahead.

Lastly, investing in the Warsaw stock exchange can be difficult.

So Pepco is fundamentally a long-term type of investment for relatively experienced investors, with rewards from the rising shop number paying off years in the future.

Holdings Disclosure

Neither I nor anyone else associated with this website has a position in Pepco or plans to initiate any positions within the 72 hours of this publication.

I wrote this article myself, and it expresses my own personal views and opinions. I am not receiving compensation from, nor do I have a business relationship with any company whose stock is mentioned in this article.

Legal Disclaimer

None of the writers or contributors of FinMasters are registered investment advisors, brokers/dealers, securities brokers, or financial planners. This article is being provided for informational and educational purposes only and on the condition that it will not form a primary basis for any investment decision.

The views about companies and their securities expressed in this article reflect the personal opinions of the individual analyst. They do not represent the opinions of Vertigo Studio SA (publishers of FinMasters) on whether to buy, sell or hold shares of any particular stock.

None of the information in our articles is intended as investment advice, as an offer or solicitation of an offer to buy or sell, or as a recommendation, endorsement, or sponsorship of any security, company, or fund. The information is general in nature and is not specific to you.

Vertigo Studio SA is not responsible and cannot be held liable for any investment decision made by you. Before using any article’s information to make an investment decision, you should seek the advice of a qualified and registered securities professional and undertake your own due diligence.

We did not receive compensation from any companies whose stock is mentioned here. No part of the writer’s compensation was, is, or will be directly or indirectly, related to the specific recommendations or views expressed in this article.

The post Pepco (PCO.WA) Stock Analysis appeared first on FinMasters.

FinMasters