If you follow financial news you have heard a lot of talk about rising interest rates over the last year. People hold rising rates responsible for the economy, oil prices, tech stock prices, currency fluctuations, and almost everything else that’s happening.

This can be really confusing for investors, considering the abundance of conflicting opinions on the topics. So here is a quick review to help you understand what’s going on.

Why Rates Matter

Interest rates are often called the price of money. They determine how expensive capital is to access for companies, but also for individuals and even governments.

We all know from our personal experience how this works. When the bank gives us a loan at a lower rate, this reduces costs of the debt we are taking out. Low rates allow us to take on more debt while paying the same amount of interest.

We are leaving a period of exceptionally low interest rates, well below historical averages. This means that getting into debt never was cheaper.

This had a few consequences:

- People and investors could take out much larger loans to pay for real estate and other assets.

- Companies could manage a large debt with minimal interest expenses.

- Governments could borrow more without worrying about interest spending.

- Speculators poured borrowed money into stock markets.

If interest rates go up, the opposite happens. Debt becomes expensive and suddenly we cannot afford some of the things we previously paid for with debt.

Why Rates Change

The Federal Reserve controls what is called the federal funds rate, which is the rate banks pay to borrow from other banks. Other interest rates throughout the system are based on that rate. Central banks in other countries have a similar rate-setting function.

When an economy is in recession or unemployment is high, the Fed lowers rates. This is meant to encourage investment and spending, pushing more money into the economy.

As the economy starts growing and unemployment reduces, the Fed typically begins to raise rates, aiming to avoid inflation of both asset prices and consumer prices.

The rate-setting process is supposed to be apolitical, which is why the Fed is separated from direct political interference. In practice, politics are deeply involved. Political pressure tends to lean toward lower rates, which are associated with a “hot” economy. Politicians like a hot economy, even when it raises the risk of a dangerous bubble.

How Rising Rates Impact Assets

Rising interest rates have different effects on different classes of assets.

Real Estate

Real estate purchases are typically financed with debt, so changes in interest rates have an immediate impact on real estate markets.

Mortgage rates are now almost at 7% in the US, the highest since 2002. This means the monthly payment for a house at an unchanged price is going up significantly. This should reduce the demand for housing.

This might cause a real estate price decline or even a crash. This might also just cause people to pay more for properties of equivalent value.

It is worth noticing this only affects new or renewed mortgages or mortgages with variable rates. People that have locked in lower fixed interest rates with fixed-rate mortgages will keep paying their low rate.

Stocks

Interest rates affect stocks in two main ways: the impact on companies and the impact on investor behavior.

Many companies “roll over” their debt. This means they never really pay their debt, just pay the interest and renew their old bonds with new ones. In this case, rising rates mean the new bonds will cost the company a lot more in interest expenses going forward.

Some companies are also highly reliant on cheap debt to keep afloat or grow. Others rely on customers spending on credit cards. These companies’ profits might suffer in an environment of rising rates.

Other companies will not care at all and look a lot better in comparison.

This is why a rising rate environment favors skilled stock pickers. A solid balance sheet, low debt, cheap valuation, or high profitability will be very valuable in an environment of rising rates.

Higher interest rates don’t just affect companies with debt, though. When interest rates are low and markets are rising there’s an overwhelming incentive to plow borrowed money into asset markets, especially for big institutions that can borrow very cheaply. That’s one of the main reasons why stocks, cryptocurrencies, and other assets boomed from 2017-2021.

When rates rise borrowed money tends to flow out of markets, depressing the values of even quality companies. That hurts investors who bought at the top, especially if they bought at the top with borrowed money. For others it creates a valuable entry point.

Long-Term Bonds

To understand the effect of interest rates on long-term bonds, we need to look at how they work. A bond is a promise to give back money in a fixed period of time (like 10 or 30 years) plus paying a fixed amount of annual interest during that period.

A value of a bond is always compared to other bonds. If “old” bonds pay 2% interest and new bonds give 4% interests, the old bonds are less valuable. This means that the value of the old bond has declined. Overall, a steadily rising interest rate environment is not one where you want to have long-duration bonds in your portfolio.

In theory, the profits on a bond are the interest it provides. In practice, such profits need to be higher than inflation to be “real” profits, instead of just “nominal” profits.

So the current environment of high inflation and rising rates is really not favorable to bond investors. Especially as most bonds issued over the last decade yielded very low returns, and even negative yields for some government bonds.

How Rising Rates Impact Inflation & Currencies

Interest rates are closely tied to both inflation and currency exchange rates.

Why Are Rates Rising?

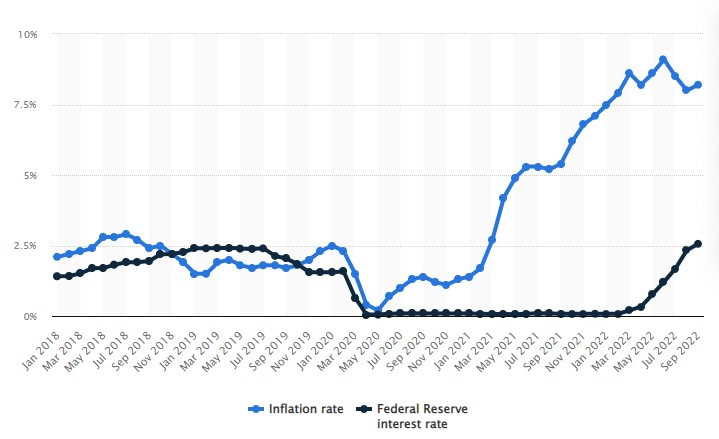

Inflation is a sign there is too much money in the financial system. One way to reduce that is to give people and businesses an incentive to take on less debt. A good way to do that is to raise rates. And this is just what the Federal Reserve is doing.

The problem with this response is that if inflation is also due to supply constraints, increasing rates will only have a limited impact. They could even restrict investment in new production that would alleviate supply constraints. So we might see inflation persist, which could drive rates even higher. Historically, rates had to be brought higher than inflation to bring inflation down.

Overall, rising rates are a useful tool to help bring inflation down. But the recent increase might not have been enough and there’s probably more to come. If inflation stays high, we would need rates to double or triple from current levels.

Currency Wars

Another effect of rising rates is on the relative values of currencies. As a rule, money will flock to currency offering a better return. Currently, the dollar is offering higher rates (through government bonds) than other major currencies like the Euro or the Japanese Yen.

This led to the dollar becoming a lot stronger. High inflation in the Eurozone and a brutal energy crisis (which I explained in detail here) did not help either.

A stronger dollar makes American exports less competitive, but also make import less expensive. This too can have wide consequences on companies’ valuation and profit, depending on their business model. This will be good for EU and Japanese exporters, and good for US importers. It will be bad for US exporters.

Many other countries and foreign companies do business in their currency, but carry debt in dollars. A strong dollar makes that debt more expensive (on top of rising rates).

This can lead to a wave of bankruptcy and default, including for entire countries, as is already the case for Sri Lanka. Even developed countries like the UK could be affected.

This is why many countries, like Japan, will try to limit the devaluation of their currency against the dollar.

Conclusion

Rising rates have a very important macroeconomic impact on the world’s economies. They affect investors through their impact on corporate, through currency exchange rates, and by restricting inflows of borrowed money to support stock prices. In an environment of rising rates, risk tends to be higher and safer, more profitable, and lower debt companies are likely to perform better.

The positive aspects for US investors:

The positive aspects for US investors:

- Rising rates support a stronger dollar.

- A strong dollar makes US imports cheaper.

- A strong dollar support consumers’ spending by decreasing import costs.

- Rising rates might help to keep inflation under control.

The negative aspects for US investors:

The negative aspects for US investors:

- Currency devaluation can hurt overseas investments measured in USD.

- Overindebted companies and consumers might not be able to manage higher rates.

- Rising rates decrease demand for big-ticket items like homes and vehicles.

- Rising rates increase the risk of a recession.

- Rising rates make US exporters less competitive.

- Rising rates restrict the use of borrowed money by investors, decreasing demand for assets across the board.

The post Rising Interest Rates: Effects on the Economy and Currencies appeared first on FinMasters.

FinMasters