Target-date funds… You’ve probably come across them while setting up your 401(k) or researching ways to save for retirement. If you’re like most people, you may be a little confused about how target-date funds work and whether they’re a good investment.

By the end of this article, you’ll know exactly:

- What target-date funds are

- How they work

- The pros and cons of target-date funds

- If they’re right for you

Let’s dive in.

What Is A Target-Date Fund?

A target-date fund is a mutual fund that automatically rebalances its asset allocation over time based on a pre-selected retirement date.

A target-date fund is a mutual fund that automatically rebalances its asset allocation over time based on a pre-selected retirement date.

For example, if you’re 32 years old in 2022 and plan to retire at age 65, you’d choose a target-date fund with a target date of 2055.

Target date funds are also known as “life cycle” or “time horizon” funds. They generally start out more aggressive, then get more conservative as your “target date” approaches.

How Do Target-Date Funds Work?

If target-date funds could be summed up into one catchphrase, it’d be Billy Maye’s Set It & Forget It.

Here’s why…

Target date funds start out with a higher percentage of stocks and aggressive investments, and then gradually shift to a mix of more conservative bonds and cash as your target date approaches. That way, you’re less likely to lose money right before you retire.

As an investor, all you have to do is choose one fund that lines up with when you want to retire and keep making contributions into that fund. Then, sit back and relax as it adjusts and rebalances over time.

It’s investing on autopilot. One fund to rule them all.

Target date funds are so popular because…

Rather than having to research a bunch of individual funds, choose the perfect mix of stocks and bonds, and rebalance everything by yourself…

Rather than having to research a bunch of individual funds, choose the perfect mix of stocks and bonds, and rebalance everything by yourself…

You just choose one fund that does it all for you.

You just choose one fund that does it all for you.

It takes the guesswork out of building wealth and makes it easy for anyone who’s nervous to get started investing.

Understanding Target-Date Fund Glide Paths

So what makes target-date funds so magical?

In short, target-date funds are able to provide a hands-off approach to investing because they automatically rebalance based on a glide path.

In simple terms, a target-date fund glide path is how your asset allocation shifts from “aggressive” to “conservative” as retirement gets closer. This process is called “de-risking.”

There are two primary types of glide paths a target date fund may follow: “to retirement” and “through retirement.”

- To retirement glide paths end when you retire. So if your target-date fund is for 2050, it will reach its most conservative point in 2050.

- Through retirement glide paths continue for maybe 10 years or so after you retire. So if you have a fund for 2050, it may not reach its most conservative point until 2060. The idea is that your retirement could last 20 or 30 years. So giving your assets more time in the growth phase could (theoretically) lead to more money in retirement.

A target-date fund with a through-retirement glide path can provide backup funds in the happy event that you live longer than expected.

What Is An Example of a Target-Date Fund?

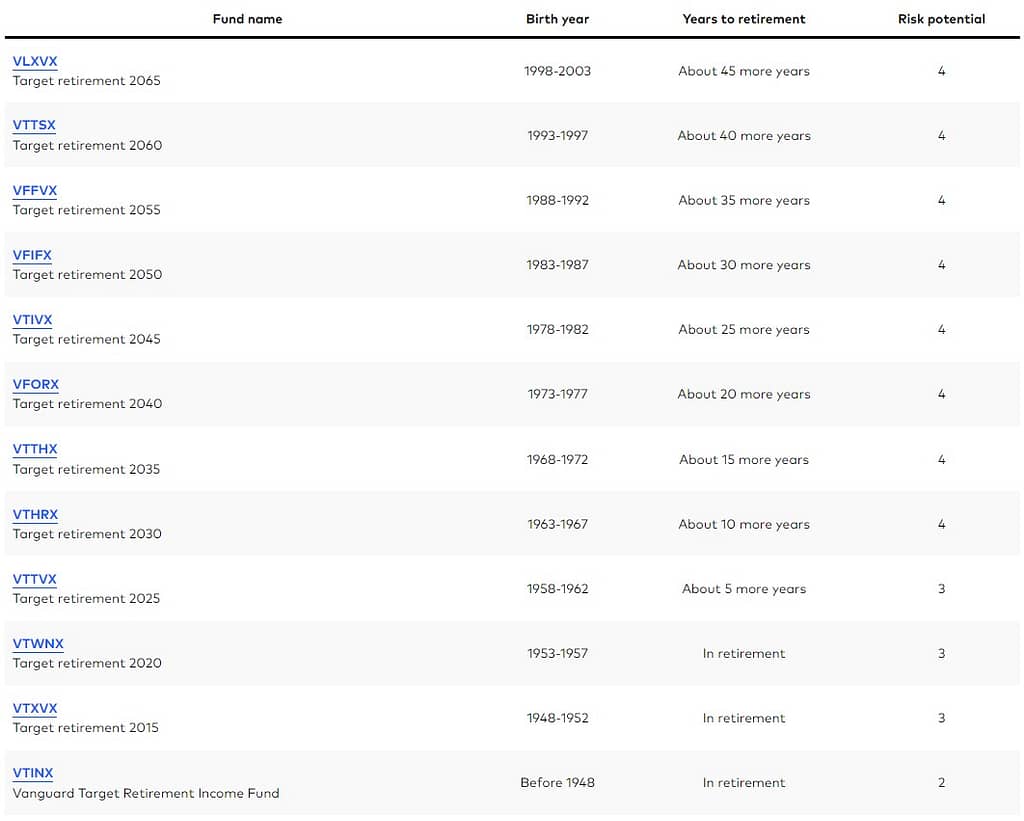

Vanguard is the top target-date fund provider, so let’s use them as an example.

Vanguard currently has 12 different target-date funds to choose from. Your choice will depend on the year you were born and when you want to retire:

For Example

For Example

Let’s say Alyssa is 22, fresh out of college, and just got her very first full-time job — congrats! She’s setting up her new 401(k) and is very confused.

All her investment options seem like alphabet soup. So, she decides to take the easy route and invest in a target-date fund. #smartgal.

Alyssa plans on retiring at a traditional age, so she decides to invest in VLXVX. It has a target retirement date of 2065 and was designed for those born between 1998 and 2003. Perfect!

Alyssa could stop right here, invest in VLXVX, and call it a day.

But if she wanted to do even more research, she could look at VLXVX’s profile on Vanguard’s website. This page would tell her that:

- VLXVX has a 0.08% expense ratio — meaning she’ll pay this much each year to hold the fund.

- It has a $1,000 investment minimum — meaning she needs at least this much before she can start investing.

- It has a current asset allocation of 89.19% stocks, 9.4% bonds, and 1.41% short-term reserves.

- It has a “through retirement” glide path because it reaches its final asset allocation within seven years after 2065.

With this information, Alyssa can compare VLXVX to other target-date funds and ultimately choose the best one for her.

Target Date Funds Pros and Cons

There’s a lot for beginner investors to love about target-date funds. But they aren’t perfect. Here’s a quick overview of the pros and cons:

Pros

Pros

- Great for beginners

- Easy to set up and manage

- Can be bought inside most 401(k)s and retirement accounts

- Provides a simple and straightforward way to invest for retirement

- Offers broad diversification with one fund

- Avoids the time, stress, and risks of stock picking

Cons

Cons

- Expense ratios can be higher than for other types of funds, which can eat into returns

- Because they’re one-size-fits-all, they don’t take into account an investor’s specialized goals, risk tolerance, or time horizon

Are Target-Date Funds a Good Investment?

So, are target-date funds a good investment? That’s the million-dollar question.

Unfortunately, the not-so-million-dollar answer is: it depends.

That said, here are a few scenarios to help you decide.

Target date funds may be right for you if:

- You’re brand new to investing

- You’re looking for the easiest way to save for retirement

- You don’t want to worry about rebalancing your portfolio or making other complex decisions

- You want to set it and forget it

- You like the idea of picking one fund based on your retirement date and letting it ride

On the contrary, you may be better off skipping target-date funds and building your own portfolio if:

- You’re an investing nerd who loves digging into data

- You want more control over your portfolio

- You’re willing to spend time monitoring and adjusting your investments over time

Quick tip: Investing is never an all-or-nothing approach. If you like the idea of target-date funds and building your own portfolio, do both. The world is your oyster, baby!

Quick tip: Investing is never an all-or-nothing approach. If you like the idea of target-date funds and building your own portfolio, do both. The world is your oyster, baby!

FAQs

What’s a Good Expense Ratio for a Target-Date Fund?

The average target-date fund has an expense ratio of 0.34%, according to Morningstar research. So a good expense ratio would be anything lower than or equal to the average.

For instance, Vanguard’s Target Retirement Fund expense ratio is 0.08% — about 76% less than the industry average.

Quick tip: Target date fund costs continue to decline every year, suggesting they may become even more affordable as time goes on.

Quick tip: Target date fund costs continue to decline every year, suggesting they may become even more affordable as time goes on.

How Do I Choose a Target-Date Fund?

Choosing a target-date fund is relatively easy. In most cases, all you need to do is log into your 401(k) or investment account and search for a target-date fund that correlates with your expected retirement date.

So if you want to retire in 2045, find a target date fund with “2045” in the title.

Once you’ve found a fund you like, transfer enough money to your investment account to buy it. You can also set up automatic contributions if you don’t want to manually buy shares each month.

Quick tip: Most target-date funds end in “0” or “5” — i.e. 2045 or 2050. So if you plan to retire in 2048, you could choose 2045 to be more conservative, 2050 to be more aggressive, or you could split the difference and invest in both.

Quick tip: Most target-date funds end in “0” or “5” — i.e. 2045 or 2050. So if you plan to retire in 2048, you could choose 2045 to be more conservative, 2050 to be more aggressive, or you could split the difference and invest in both.

Are Target-Date Funds Low Risk?

Target date funds are designed to be low-risk if you buy and hold them for the long term. However, all investments carry risk and returns are never guaranteed.

It’s important to read a fund’s profile or prospectus carefully to make sure you understand the level of risk involved.

What’s the Difference Between Target-Date Funds and Index Funds?

Target date funds are a type of mutual fund that invests in a mix of stocks, bonds, and other assets. This mix starts out aggressive and slowly starts to shift as you get closer to retirement.

Index funds, on the other hand, track a specific market index, such as the S&P 500. This means they’re made up of the same stocks that are in the index and nothing else.

As a general guideline, it’s a good idea to invest in several index funds to make sure you’re properly diversified if you choose to build your portfolio around index funds. In contrast, you may only need one target-date fund to get the job done.

What Should I Do With My Target-Date Fund After Retirement?

The short answer is nothing. Even after your retirement date passes, your fund will continue to invest based on its glide path or final asset allocation mix. If you’re happy with it as-is, you can sit back and keep on letting it do its thing.

However, if you think your target-date fund is a bit too conservative, you could sell some of it and buy more stocks or stock equivalents instead.

You may also sell all or part of your holding if you need money for living expenses or if your retirement account has mandatory distributions starting at a fixed age, like a conventional 401(k) or IRA.

You may pay taxes on whatever you sell, depending on your account type. For instance, you could be subject to:

- Ordinary income tax on traditional 401(k) and IRA distributions

- Capital gains tax on regular brokerage account distributions

- No tax on Roth 401(k) or IRA distributions (because you already paid taxes upfront)

To learn more about taxes on retirement accounts, check out our guide on Roth vs. traditional retirement accounts.

The post Target-Date Funds: How They Work & Are They a Good Investment appeared first on FinMasters.

FinMasters